Introduction

In an era where technology dictates the pace and direction of markets, the venture capital (VC) industry is entering a transformative phase marked by a data-driven revolution.

Despite their pioneering role in the digital age, VC firms have only recently begun to integrate advanced data practices into their decision-making processes and workflows. To drive this shift, VCs are establishing dedicated data divisions and hiring engineers, developers, data scientists, and product managers.

This strategic pivot aims to enhance competitiveness, operational efficiency, and investment effectiveness in an increasingly complex market. It mirrors the revolution in algorithmic trading that transformed public markets in the 1980s.

Looking ahead, we foresee a landscape where VC thought leaders will have a high rate of engineering talent at both operational and management levels. As of 2023, only 1% of VC firms globally had internal data-driven initiatives*, with a small fraction at the forefront. At P101, we spearheaded this shift in Italy by establishing the Data Insight division in 2022, aiming to drive data-driven initiatives, and we have been recognized among the leading 190 data-driven venture firms worldwide*.

*Source: Data-driven VC Landscape 2023 – Data-driven VC Landscape 2024

Why Now

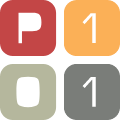

The data-driven revolution in venture capital is accelerating due to two pivotal factors:

- Data Availability: Venture capitalists now have unprecedented access to varied data types at the startup stage, including financial metrics, consumer behavior analytics, market penetration, and competitive landscape insights.

- Technological Advancements: Venture capitalists now have access to off-the-shelf VC-focused tools, as well as analytics and AI technologies, capable of analyzing both structured and unstructured data, even with limited data points.

A decade ago, the venture capital sector lacked accessible, reliable data, with un-digitized public registers and nascent platforms like Crunchbase and LinkedIn offering limited information. Now, venture capitalists access abundant public data, utilize specialized data services, and develop proprietary datasets to stay competitive.

This surge in data availability coincides with advances in analytics and AI technologies, including machine learning models, large language models (LLMs), and natural language processing (NLP) technologies. These advancements have automated data analysis and generated insights from unstructured data sources, enhancing the depth and accuracy of investment evaluations.

The emergence of “Investment Tech” tools is further driving the current data-driven transition. While established in public markets, these tools are now evolving for private markets. Investment tech comprises specialized software and platforms that enhance deal sourcing, due diligence, portfolio management, and reporting to optimize investment processes and decision-making. These tools democratize advanced investment capabilities, making them accessible to more venture capitalists and enhancing the reach of data-driven investing.

This transformation allows venture capital to move from reliance on intuition and personal networks to an evidence-based approach similar to methods used in more mature asset classes. Armed with comprehensive data and powerful analytical tools, venture capitalists can now cover the market more comprehensively, track startup progress more effectively, and make strategic investment decisions with increased speed and accuracy.

Source: P101 Data Insight

What is a Data-Driven VC

A data-driven venture capital fund leverages data analytics and technology to enhance its investment decisions and operations.

Historically, venture capital has relied heavily on gut instincts and personal networks. However, the digital age demands a more sophisticated approach. VC firms are now creating dedicated data divisions – hiring engineers, developers, data scientists and product managers – to harness the power of data, focusing on three key areas:

- Efficiency: By structuring and digitizing operations, VCs can scale while maintaining consistent performance, manage larger portfolios with fewer resources, reduce operational costs, and improve marginality and responsiveness.

- Effectiveness: Expanding VC’s coverage and reach enhances the ability to anticipate industry trends and refine investment accuracy. This reduces biases and inequalities in capital allocation and decreases the likelihood of missing opportunities or backing underperformers.

- Competitiveness: Leveraging data-driven strategies serves as a key differentiator, appealing to both innovative startups and investors. VCs can offer new and improved services to LPs and portfolio companies, such as advanced data portals, performance benchmarking, and interactive fund reporting.

Balancing data-driven insights with traditional, qualitative methods is essential in venture capital. Human judgment, such as assessing leadership qualities and understanding market dynamics, remains indispensable. While data can identify trends and opportunities, the nuances of strategic decisions depend on human expertise. Thus, the most effective VC strategies combine analytics with the critical insights that only people can provide.

The Recipe of a Data-Driven VC

Contrary to the common misconception, becoming data-driven in venture capital isn’t solely about deploying advanced AI algorithms, Machine Learning models, or purchasing cutting-edge technology. The journey to becoming data-driven starts with fundamental, yet crucial steps that lay the groundwork for building a comprehensive data-driven infrastructure.

While newer VC firms benefit from greenfield situations, established ones encounter greater challenges due to the need for migrating existing systems, changing processes and overcoming cultural resistance.

The recipe for a successful transformation into a data-driven VC involves several critical ingredients:

- Strategic Hiring: The foundation of a data-driven VC firm is its people. Recruiting talented engineers, data scientists, software developers and product managers who collaborate closely with investment and fund administration teams is crucial. These professionals drive the firm’s transformation by integrating new technologies and data insights into everyday processes.

- Process Engineering: Transitioning to data-driven operations requires a thorough overhaul of existing processes. This involves mapping and analyzing current workflows to identify pain points, bottlenecks, and areas ripe for improvement and automation. By redesigning these processes, firms can maximize technology use, streamline operations, and enhance efficiency.

- Technology Investment: A balanced approach to technology—incorporating both advanced off-the-shelf software and custom-developed tools—is essential. These technologies should address specific needs in domains such as databases, process automation, data analytics, business intelligence, CRMs, portfolio management tools. Investing in the right technology stack enables firms to handle complex data and derive actionable insights effectively.

- Cultural Shift: Adopting a data-driven model necessitates a shift in corporate culture. This shift involves promoting data literacy across all organizational levels and valuing data-driven insights as much as traditional investment acumen. A culture that embraces innovation and informed decision-making not only supports data initiatives but also propels the firm ahead of its competitors.

This strategic blend of people, processes, technology, and culture forms the essential blueprint for any VC firm aiming to thrive in today’s data-intensive environment.

The Path to Becoming a Data-Driven VC

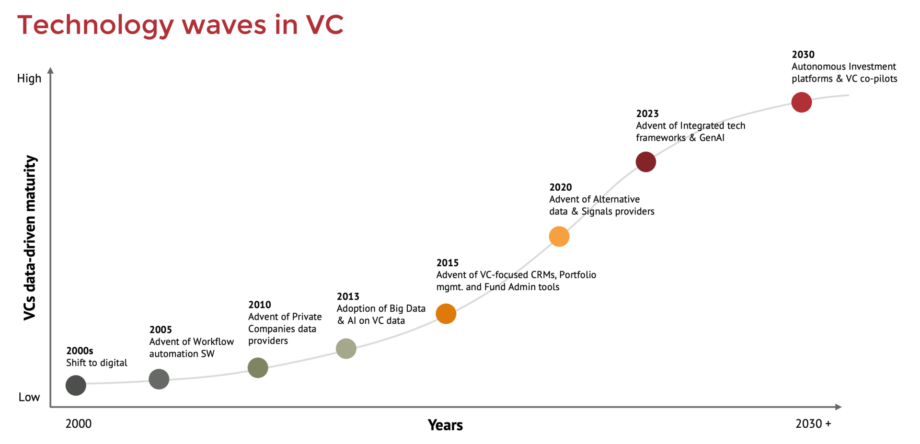

Venture capital firms evolve gradually through various stages of data utilization and sophistication, changing the paradigm of the required skills and tool sets. Data and engineering roles are now on top of the VC hiring agenda to drive the move towards the Data-Driven stage. This iterative journey enhances their capabilities in data handling and decision-making processes. Currently most VCs sit within the Traditional and Productivity stages. Here are the three stages of maturity in becoming a data-driven VC*:

- Traditional VCs: These firms rely heavily on manual workflows, with minimal collaboration. Their technological stack includes basic tools like legacy CRMs, email, Slack or WhatsApp for communication, and Excel for database management along with the standard MS Office or GSuite.

- Data Team: Non-existent, as there is no dedicated personnel for data management or analysis.

- Productivity VCs: At this stage, firms focus on automating and industrializing processes. They adopt specialized, off-the-shelf tools tailored for VCs, such as CRMs (Affinity, Attio), portfolio management software (Rundit, Vestberry), valuation tools (Valutico), and project management and knowledge sharing platforms (Notion). Additionally, they integrate automated workflow tools (Zapier), GenAI agents (OpenAI, Gemini, Claude, Perplexity), and efficient scheduling software (Calendly).

- Data Team: Consists of individuals with a technical background, though not necessarily engineers, as extensive coding skills are not required.

- Data-Driven VCs: These firms are highly sophisticated, focusing on developing their own custom and scalable solutions. They use advanced programming and DevOps tools (Python, Java, GitHub, Airflow), tap into alternative data sources (Specter, Synaptic), and leverage robust cloud infrastructure and computing platforms (AWS, GCP, Azure). They also manage custom databases (PostgreSQL, MySQL, MongoDB) and utilize sophisticated workflow management platforms (Airflow) and custom front-ends and business intelligence tools.

- Data Team: Comprises highly technical roles, including data engineers, software developers, and data scientists, all integral to the firm’s data strategy.

Each stage marks a significant progression in a VC firm’s journey towards fully integrating data-driven methodologies, each more advanced and integrated than the last.

*Source: Data-driven VC Landscape 2023 – image replicated

The Make or Buy dilemma

In the realm of data-driven venture capital, the strategic “Make or Buy?” decision – whether to build in-house solutions or purchase off-the-shelf products – is crucial and often hinges on the capital availability and budget of the VC firm.

The fund’s size is pivotal, as management fees from the fund size directly affect the budget for these initiatives. Smaller funds, typically under €100 million, tend to purchase off-the-shelf solutions due to budget constraints. They gradually build basic bespoke tools as resources allow, such as basic process automation, custom databases, and data pipelines.

In contrast, larger firms with more capital can invest in developing advanced custom tools tailored to their needs, like proprietary deal sourcing platforms, advanced screening models, due diligence tools, and portfolio monitoring software.

Investment Technology plays a vital role in this transition, offering off-the-shelf solutions that enable VCs to adopt data-driven practices without building proprietary technologies from scratch. Hence, the buy option is increasingly more valid since there are increasingly more tools that perform tasks that previously were achievable only through custom solutions.

Though, investment tech tools are poised to become commoditized and VCs will need to differentiate in two ways:

- Implementation and Exploitation: The way tools are implemented and integrated into workflows and operations. Similar to how everyone can buy Coca-Cola ingredients, but the unique processing creates the secret recipe.

- Custom Tools: Developing tools that reflect the specific methodologies and cultural nuances of a firm. Unique application and integration of these tools provide a competitive edge in the industry.

The most effective strategy often turns out to be a hybrid approach, balancing off-the-shelf products with custom development based on the firm’s strategy and capital availability. This tailored approach allows VCs to leverage the strengths of both options, optimizing their technological investments to suit their specific needs and financial capacity.

Automating the VC Investment process

A key question in venture capital today is whether the investment process can become fully automated, akin to the algorithmic trading that currently dominates over 70% of the public equity market.

The short answer is: it could happen, but not in the near future. VC investments are intrinsically tied to qualitative valuations and human interactions. Understanding a team’s dynamics, the startup’s culture, evaluating the timing and execution capabilities, and navigating the term sheet negotiation and due diligence phases are all deeply human aspects that challenge straightforward codification into software or machines. Moreover, investment commitments often depend on trust, partnership, shared vision, and intuition between the investor and the entrepreneur, akin to a marriage.

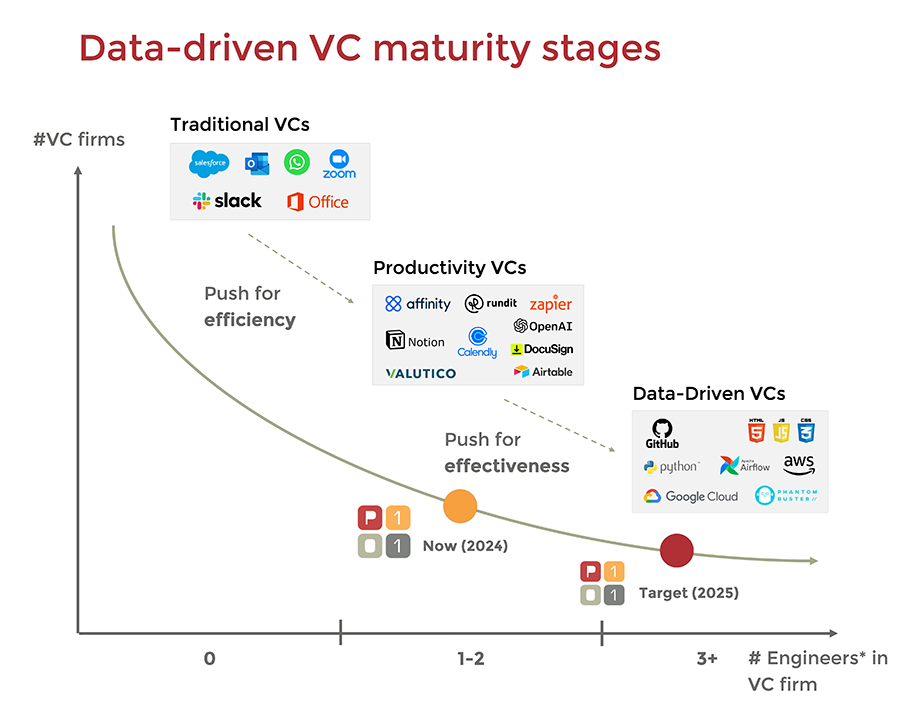

Hence, different phases of the data-driven VC process exhibit varying automation potentials.

In the initial stages of the value chain, such as Sourcing and Screening of investment opportunities, the potential for automation is highest. These stages are highly data-centric, allowing for the use of algorithms to efficiently sift through vast amounts of data to identify promising opportunities.

Similarly, the Portfolio Monitoring phase, which involves collecting and analyzing key performance indicators (KPIs) from companies and maximizing the VC network’s potential through advanced data analytics, is well-suited to automation.

In contrast, the Due Diligence phase presents a medium automation potential. Although numerous tools and use cases, especially those driven by Generative AI, are being developed to enhance due diligence by connecting and interpreting diverse data formats in data rooms, the necessity for nuanced judgment and deeper insights into qualitative data still requires significant human involvement.

Furthermore, the phases of Deal Structuring & Closing and Follow-on & Exit demonstrate low automation potential. These stages are critical for establishing trust and negotiating terms, involving intricate interactions with third parties and detailed contract drafting that rely heavily on nuanced human skills and interpersonal relations. As such, these aspects of the venture capital process underscore the indispensable role of human intuition and judgment, elements that are currently beyond the reach of full automation.

This gradation in automation potential across different stages highlights a blended approach where technology complements human expertise, rather than replacing it, ensuring that venture capital retains its strategic and human-centric character even as it leverages the benefits of technological advancements.

Source: Data-driven VC Landscape 2024 & P101 Data Insight

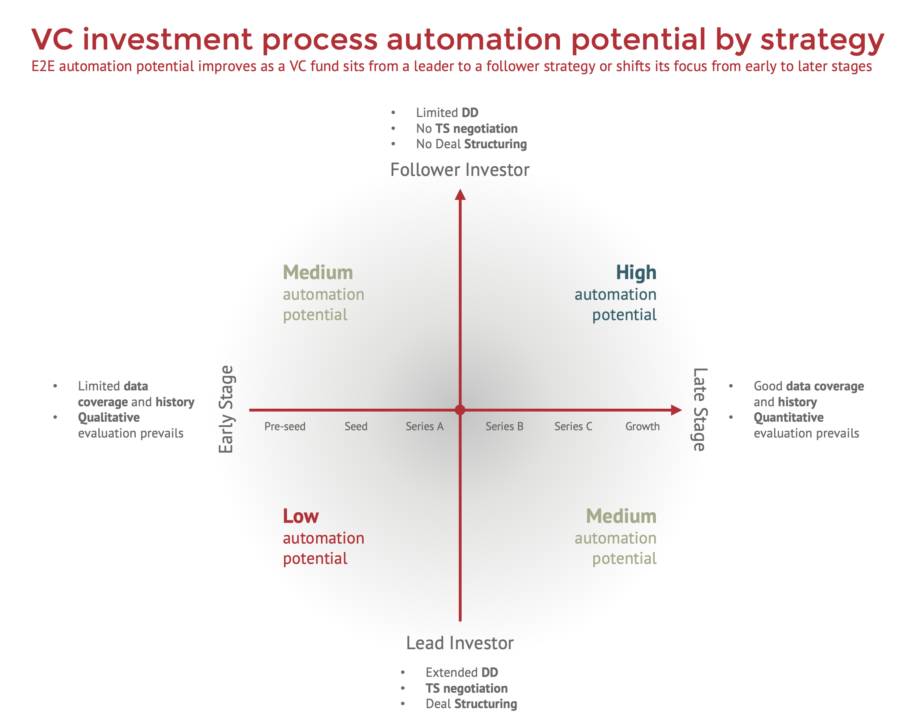

Further dissecting the investment process and considering strategic variables of a VC fund, such as whether a VC acts as leader or follower, and whether it focuses on early-stage or late-stage investments, reveals a different perspective in automation potential:

- Late Stage, Follower Strategy: High end-to-end automation potential. These funds benefit from extensive data availability and historical performance metrics of target companies and markets. Investment decisions in this context are primarily driven by quantitative data. Additionally, as follower investors often engage in limited due diligence and are not deeply involved in negotiating terms or deal structuring, the process lends itself more easily to automation.

- Early Stage, Leader Strategy: Low end-to-end automation potential. Pre-seed and Seed investments are characterized by scant data coverage and limited historical insight, necessitating a heavy reliance on qualitative assessments. Such funds must undertake comprehensive due diligence with minimal data and take the lead in negotiating all contract terms of a deal, processes that are less amenable to automation. However, this strategy allows for the automation of certain operational aspects, increasing productivity and allowing human capital to focus on where it is most impactful: fostering relationships and strategic decision-making.

Source: P101 Data Insight

For VC funds between these extremes, the automation potential improves as they transition from a leader to a follower strategy or shift focus from early to later stages. Incremental moves along these spectrums enhance the feasibility of automating aspects of the investment process.

In conclusion, while certain elements of the VC investment process, particularly data-rich, late-stage evaluations, can be automated, complete automation remains complex and strategy-dependent. The balance between quantitative ease and qualitative depth dictates the pace and extent of automation in venture capital.

Digitizing VC Investor Relations

Digitizing investor relations and fund administration processes allows VC firms to improve internal efficiencies and offer superior services to Limited Partners, which is essential for attracting and retaining investors in a competitive market.

This strategic move fosters trust and transparency, ensuring effective communication and timely responses, enhancing the sophistication and reliability perceived by investors.

Three main areas can be addressed:

- Streamlined Onboarding and Compliance: Transitioning from manual to automated onboarding processes allows for digital onboarding of investors to be completed in minutes rather than days. Streamlined Know Your Customer (KYC) processes use software to instantly verify identities and perform background checks, reducing turnaround times and staff workload.

- Advanced Investor Portals: Advanced investor portals provide LPs on-demand access to extensive fund data, including proprietary insights, market research, and detailed portfolio analyses. Interactive tools such as chatbots and AI assistants offer immediate responses to LP inquiries, enhancing the investor experience by eliminating the need for scheduled meetings or calls with fund managers. This technology fosters deeper relationships between investors and the fund, such as sharing deal opportunities, involvement in direct investments and leveraging LPs networks to support portfolio companies.

- Automated Fund Administration: Automation in fund administration facilitates the precise and timely management of commitments, capital calls, and distributions. These processes are less prone to errors and are fully transparent, enabling both internal teams and investors to track transactions in real-time. This transparency increases trust and investor confidence as it allows them to view transaction statuses and histories whenever needed.

P101’s Data-Driven VC journey

In 2022, P101 established a dedicated business unit called Data Insight to drive our data-driven transformation. This team orchestrates various initiatives to enhance competitiveness, operational efficiency, and investment effectiveness.

Laying the foundation

We began by thoroughly mapping and redesigning all investment, fund administration, and back-office processes. Thereafter, we created reliable, user-friendly, and scalable databases and data models to support our evolving business needs without compromising efficiency or scalability.

Integrating Off-the-Shelf Solutions

Recognizing the immediate benefits of existing technologies, we initially invested in off-the-shelf investment tech tools. This included everything from data providers to CRM systems, portfolio management, valuation, reporting, and administrative tools. These tools were selected for their quick-win potential, providing substantial value in a relatively short timeframe. Each tool was carefully integrated and configured to align with our specific processes, accompanied by a comprehensive change management and team training program to maximize their utility.

Developing custom solutions

With a solid infrastructure in place, we are now creating a roadmap for developing custom solutions tailored to our unique operational needs.

This roadmap includes plans for data lakes that will aggregate diverse data sources such as web crawlers, news, social networks, job boards, and industry reports. We aim to build sophisticated data processing and analytics layers that will identify market opportunities, spot emerging startups, track key personnel movements, and more.

Other custom initiatives include developing proprietary indexes and signals to score and screen companies, utilizing Machine Learning (ML) models and Generative AI (Gen AI) agents for tasks such as drafting term sheets, conducting due diligence checks, valuing companies, analyzing portfolios, drafting automated limited partner reports, identifying optimal exit scenarios, and collecting and analyzing data from portfolio companies. Additionally, we plan to create custom front-ends to ensure all team members access this rich technological and informational estate, enhancing workflows.

Ongoing evaluation and improvement

To ensure continuous improvement and responsiveness to technological advancements, we hold weekly update sessions. The Data Insight team reviews ongoing initiatives, evaluates new proposals, and adjusts priorities based on a rigorous cost-to-benefit analysis. These initiatives span process reviews, database enhancements, adoption of new tools, automation of existing processes, specific data role hiring, and comprehensive training programs.

Through these efforts, P101 adapts to the demands of a data-driven landscape and sets a benchmark for innovation and efficiency in venture capital management. Our proactive approach to integrating off-the-shelf solutions and planning for custom tools exemplifies our commitment to harnessing data to drive better investment decisions and operational excellence.

Risks and challenges on the road ahead

As venture capital firms transition towards a data-driven approach, they face several significant risks and challenges that could impact the effectiveness and efficiency of their transformation:

- Data Privacy and Security: Handling vast datasets increases risks related to data breaches and compliance with strict data protection regulations like GDPR.

- Integration and Interoperability: Integrating new data tools with existing systems can cause technical challenges, requiring sophisticated solutions to ensure seamless workflow compatibility.

- Cultural Resistance: Shifting to data-driven methods may encounter resistance from employees accustomed to traditional practices, necessitating strong change management strategies.

- Skill Gaps and Talent Acquisition: There is a high demand for skilled data professionals. VC firms must compete with tech giants for this limited talent pool, highlighting the need for effective recruitment and retention strategies.

- Overreliance on Quantitative Analysis: Excessive focus on data can lead to the underappreciation of qualitative factors such as leadership qualities and founder passion, which are crucial in venture capital.

- Cost Implications: The expense of implementing and maintaining advanced data analytics and AI tools can be substantial, particularly for smaller firms, potentially affecting the return on investment.

- Technological Obsolescence: Rapid advancements in technology require continuous updates and investments, posing a challenge to keep pace with new developments without falling behind.

- Data-Driven Bias: There is a risk of perpetuating biases if AI models and algorithms are trained on skewed data sets, necessitating careful scrutiny to ensure ethical use of data.

Addressing these challenges requires careful planning, resource allocation, and ongoing management commitment to ensure the successful integration of data-driven strategies within venture capital operations.

Conclusion

For VCs, the data-driven revolution is not just another trend but a foundational shift essential for survival and success in the digital era. By embracing this change, VCs can enhance their operational efficiency, improve their investment accuracy, and stand out in a crowded market. The journey will require substantial investment in technology and talent, along with a firm commitment to reshaping the organizational culture. Those willing to take the lead will likely find themselves at the forefront of tomorrow’s venture capital landscape, setting new standards for success and innovation.

Loquis, the free innovative travel podcasting platform founded by Bruno Pellegrini, has successfully secured €3.78 million in funding, setting the stage for international expansion. P101 led the round, followed by Lazio Innova through the INNOVA Venture Fund of the Lazio Region, PiCampus, and CDP Venture Capital.

By combining audio stories with iconic locations, Loquis helps brands and destinations sharing their voice with travellers around the world.

Loquis, the first open and free travel podcast platform, closed 2023 doubling its audience and revenues. Bruno Pellegrini’s brainchild has become Italy’s go-to audio platform for both travellers and storytellers eager to weave tales of the territory. Additionally, at the end of last year, the Company closed a €3.78 million capital increase led by P101 SGR, a leading Italian Venture Capital player with a European focus. Through the fresh capital infusion, Loquis is poised to unleash its potential on a global scale.

We live in a society that rushes, gets distracted, and forgets. Loquis call to pause, listen, and uncover the hidden gems strewn across the world’s landscape. Through Loquis, every street corner, river bend, and mountain pass come alive with the authentic voices of those who cherish these stories and are eager to share them with the world. Loquis app challenges conventionality with a gentle revolution that is profoundly democratic and inclusive, driven by cutting-edge technology, including artificial intelligence, and a deep respect for human connection. Loquis serves as a virtual treasure trove, where every contribution echoes the vibrant narratives of the places we hold dear. It is more than just a platform, it is a sprawling atlas teeming with stories waiting to be uncovered. Here, anyone can step up to the mic and share the tales of their origins, their journeys of migration, or the places they now call home. As these stories unfold, they paint a vivid tapestry of Italy, one that beckons us to venture beyond the well-trodden paths of mass tourism. Away from the selfie-stick wielding crowds, Loquis invites us to rediscover the essence of Italy in all its unexplored glory. For true travel is not just about ticking off destinations like items on a checklist, it is about immersing ourselves in the rich tapestry of every place, listening intently to its tales, and uncovering its hidden treasures, one story at a time.

In 2023, approximately 2 million tourists embraced this innovative formula and listened to the platform’s content a total of over 6 million times, resulting in a production value that doubled from €350,000 to €700,000 year on year. Loquis also partnered with dozens of the most prominent operators in the Italian travel and mobility sector, such as Slow Food, Autostrade per l’Italia, Anas, Trenitalia, Dove, PleinAir, along with hundreds of municipalities and tourism promotion entities that decided to present themselves by telling their stories in the simplest and most immediate format: the voice.

Entirely developed in-house, the Loquis platform harnesses cutting-edge technologies to bring to life their vision of becoming a global storytelling hub. This vision is encapsulated in the new tagline: “Loquis, a World of Stories”.

In light of the successful completion of the capital increase, Loquis can now rely on new funds to be deployed for further platform development and international business expansion.

P101 acted as the Lead Investor investing €2.2 million in Loquis through the Programma 103 and Azimut Eltif Venture Capital P103 funds, benefitting from the support of the European Union under the InvestEU Fund.

As part of the operation, Lazio Innova also joined Loquis’ capital through the INNOVA Venture fund of the Lazio Region, alongside PiCampus and CDP Venture Capital through the conversion of participatory financial instruments and previously signed agreements. Additionally, the capital increase was subscribed by several Business Angels who have been supporting Loquis since the early days, including Carlo Feltrinelli, using previously subscribed instruments.

Overall, the round closed with an increase in the company’s share capital of €3.78 million, of which €2.7 million flowed in from new investors and €1.1 million through the conversion of participatory financial instruments.

“Our goal – explains Bruno Pellegrini, CEO and founder of Loquis – is to weave the stories from every corner of the globe, establishing ourselves as an indispensable resource for travellers and industry professionals in the tourism and culture sectors. As pioneers in the travel podcasting segment, our numbers in the Italian market already surpass those of any other platform in the travel category, mainly owing to our specialization and utilization of geolocation technology. Thanks to the confidence shown by our new investors in the potential of our business model and our innovative use of AI, we are poised to embark on a journey of international expansion. This expansion will entail comprehensive global content coverage, reaching an estimated 3 million listeners within 24 months. We also plan to extend our reach to key European markets, opening a new office in Spain, and increasing our investments in research and development to continuously improve the user experience and performance of our platform”.

“The travel tech industry is experiencing a strong phase of expansion supported by the integration of artificial intelligence systems and the development of new B2B models. At P101, we have gained deep expertise in the sector, which we will leverage for the benefit of Loquis and its international growth, which can and should start right from Rome and Italy,” commented Andrea Di Camillo, Founder and Managing Partner of P101. “The company has great potential, and thanks to a highly skilled team, it is developing technology and content that will increasingly be of interest not only to consumers, but also to businesses. We are therefore excited to support Loquis’ new growth phase, marking our eighth investment through Programma 103 within its first twelve months of operation”.

In the operation, P101 and Loquis were assisted by BonelliErede and FavaLegal respectively, acting as legal advisors.

***

Loquis

Loquis is the first open and free travel podcast platform conceived by Bruno Pellegrini, a pioneer of digital innovation in Italy, which collects stories from around the world. Anyone can access it and start telling their story, contributing to the creation of an audio atlas (currently available in 7 languages) that enriches the travel experience and offers a new channel for the enhancement of the territory. The platform has been developed entirely in-house and seeks stories and meaningful journeys for a renewed dimension of travel, towards a completely screenless approach, using new technologies and developments in artificial intelligence in a humanistic manner.

P101 SGR

P101 SGR stands as a prominent venture capital fund manager in Italy, specializing in investments in innovative and technology-driven European companies. Established in 2013 by Andrea Di Camillo, the firm boasts a diverse investor base, including Azimut, CDP, European Investment Fund, Fondo Pensione BCC, Unicredit, Cassa Forense, and other institutional investors, along with significant contributions from major Italian entrepreneurial families. P101 SGR currently manages five funds, including the first retail investment vehicle for venture capital developed in collaboration with Azimut Group. With assets under management totalling 400 million euros, P101 has completed over 260 investments in more than 50 companies, generating approximately 1.7 billion euros in revenue in 2023 and employing over 5000 people. Throughout its 10+ years of operation, P101 has been instrumental in fostering the development of the Italian innovation ecosystem, supporting the growth and international expansion of companies such as Fatmap (Strava), Habyt, Milkman, MusixMatch, Tannico, Deporvillage, and Musement.

- Impressive growth trajectory over the decade in terms of volumes, investments, the establishment of innovative companies, and its impact on the economy.

- Approximately 8 billion euros invested in Italian startups over the past 10 years, reflecting a valuation of 67 billion euros in 2023.

- Italian startups and innovative SMEs collectively generated a turnover exceeding 9.3 billion euros in 2023.

- Investments in Italian startups reached €1.1 billion in 2023, with a notable increase in the prevalence of Growth Stage rounds.

- In the last 5 years, VC fundraising activity in Europe totalled EUR 108.7 billion; although 2023 witnessed a decline (-32% YoY), Italy defies the trend with a notable increase (+88% YoY).

P101 has delved into the evolution of its sector over the past decade, scrutinizing specific trends and aligning them with the broader European landscape.

The report, titled “State of Italian VC,” shines a light on the impressive growth of Italian Venture Capital (“VC”) in the last 10 years, acting as a catalyst for the nation’s innovation ecosystem. From 2013 to 2023, Italian VC has injected a substantial 8 billion euros into startups, witnessing a remarkable surge from 152.1 million euros in 2013 to a staggering 1.1 billion euros in 2023. This growth, averaging an impressive 644%, outpaces the European average of 492.5%.

Over the same period, the number of completed transactions has risen from 294 to 387, marking a 31% increase, compared to Europe’s 80%. This hints at a notable upswing in the average size of Italian deals. Despite 2023 macroeconomic uncertainties causing a dip in investments (-55% YoY) and in number of rounds (-30% YoY) in 2023, in line with European trends (-43% and -21% in France and -37% and -19% in Spain), the overall growth trajectory of the Italian ecosystem (+644% over the decade) remains robust.

The burgeoning investment pace has also contributed to the growth of over 13,000 startups and around 2,000 SMEs in Italy. In 2023 alone, these entities generated a turnover of over 9.3 billion euros, employing approximately 62,000 people. The valuation of the Italian Startup ecosystem, standing at around 67 billion euros (Enterprise Value), has increased 25 times over the past 10 years, more than double the European average, with accelerated growth in 2023 recording a 27% YoY increase (7% in Europe). This growth underscores the scalability of business models and the emergence of entities with further development potential, particularly in the technology sector.

While the value of Italian startups in 2023 is comparable to Spain in 2020, France in 2016, and Germany in 2015, indicating a temporal gap in development, the surge in the number of VC-backed companies in Italy (from 726 in 2013 to 2,983 in 2023, a +271% increase) sets the stage for accelerated development. The average valuation of Italian startups in 2023 surpassed 22 million euros, recording the highest compound annual growth rate (+19%) of the decade. Countries like Germany and France still showcase average valuations nearly twice as high as those in Italy, which is still in the early stages of development. However, the data highlights an ongoing maturation process within the Italian ecosystem.

In the last 5 years, European VC funds have raised approximately 109 billion euros, experiencing a 32% decline in 2023 (YoY). However, Italy stands out with an 88% year-on-year increase, with 3.6 billion euros raised by new VC funds. In addition to that, 2023 also witnessed a notable 71% increase in the average size of Italian funds. Despite being in a growth phase, the Italian market lags behind more mature ecosystems. Nevertheless, the consistent increase in the number of new VC funds (from 3 in 2019 to 11 in 2023) and their increasing average size signal a deepening and diversifying market, reflecting growing investor confidence and a broader range of investment opportunities in the country.

“We aim to conduct a comprehensive analysis to spotlight the remarkable journey undertaken by Italian Venture Capital and shed light on its potential for further growth,” remarked Andrea Di Camillo, Founder and Managing Partner of P101. “The overall growth trajectory over the past decade has been substantial, encompassing volumes, investments, the creation of innovative enterprises, and a significant impact on the economy. In 2023 alone, the 52 companies in which P101 has invested generated approximately 1.7 billion euros in revenue – contributing to a total of 5 billion over the decade – while providing employment to over 5,000 people. Industry insights affirm that the groundwork for the Italian Venture Capital ecosystem is now complete. We must look forward to the next decade, furtherly bridging the gap with leading European countries. More importantly, we must brace ourselves for the challenges the ecosystem will encounter as it evolves into a new phase of maturity, ushering in changing rules of the game. Opportunities and competition will escalate, with international players showing a growing interest in our country. Emerging drivers, such as Artificial Intelligence, will reshape investment trends, increasingly honing in on services for businesses. We expect an upswing in the sizes of funds, investments, and startups: companies that have thrived in the past decade now showcase the scalability of their business and stand poised for a dimensional leap that will frequently extend beyond borders. As Venture Capital players, our role is not just to navigate but to lead this transformative shift towards new business models, keeping in mind the core objective of the sector: contributing to the development of the Italian innovation ecosystem.”

State of Italian VC

Tracing Evolution and Market Opportunities

Mundimoto is a Spanish digital startup focused on selling and buying motorbikes. It offers an online, fast and guaranteed service. Mundimoto was created in 2019, And since then it has become the largest motorcycle marketplace in Europe with 60M euros turnover in 2022. The company is located in Barcelona, Madrid, has recently opened in Milan and over the years has reached 250 employees.

What is the added value that tells Mundimoto apart from its competitors?

“There are quite a few differences between the service offered by Mundimoto and the ones offered by other players that might look a bit like us. First, we have the largest stock of second-hand motorcycles in Europe, so users can find the motorcycle of their dreams among many. In addition, at Mundimoto we always offer the best service and individual attention to each of our users”, said Josep Talavera, co-founder and CEO of Mundimoto.

In fact, Mundimoto not only offers the best service, but also expands and adapts its products and services whenever it detects new trends or market needs. For example, this year Mundimoto has launched a pay-per-use or renting service that allows people to enjoy the motorcycle of their dreams for as long as they need it. To make all this possible, Mundimoto has developed one of the best technological equipments, in this way it can make sure that its platform always works in the best way and provides the quality service that Mundimoto’s users and customers deserve.

The technology behind Mundimoto

Mundimoto has developed proprietary algorithms to price used motorbikes in real time and to source vehicles at scale. The platform’s infrastructure allows to manage large quantities of inventory in different countries and to overlook the entire lifecycle of the motorbikes from when Mundimoto purchases them until the moment they are sold. In addition to that, Mundimoto has built an e-commerce platform to sell motorbikes autonomously and cross-selling services on top such as financing, insurance, warranties and refurbishment.

How did Mundimoto meet P101?

We met P101 through Stefano Guidotti who was referenced to us by a friend.

Mundimoto’s business model and top customers

Mundimoto buys and sells motorbikes online offering services on top such as consumer financing, insurance, warranties and refurbishment. More recently, the company has launched a subscription service where customers can pay a monthly fee that includes the vehicle and all the services that are needed to ride it (insurance, maintenance, etc.).

Mundimoto’s future goals

By the end of 2023 Mundimoto expects to be sell 25,000 vehicles and to consolidate its position in the countries where it operates – Spain and Italy – as well as to carry out a sustainable growth strategy that will allow the company to become a European leader in this market.

Casavo is a technological platform for the real estate and residential markets that aims to redesign and change the ways people buy and sell houses in Europe by providing an integrated experience. The startup was founded in Milan by Giorgio Tinacci at the end of 2017. “From the beginning, our goal was to build a tech platform that could offer a simpler, more convenient user experience, one that would be more in line with the needs of new generations. The project was born at the end of 2017 in Italy as the southern European market was interesting from the point of view of market fundamentals, but it also showed certain inefficiencies that we could solve”, stated Giorgio Tinacci. Over the years, Casavo has expanded overall Europe, in particular to Spain and France.

Casavo started by focusing on sellers, since usually the real estate transaction starts from a person’s need to sell their property. The biggest problem is that selling is a very long process: on average, in the main metropolitan areas, it takes about 200 days to close a real estate transaction. It’s a very complex process grounded on a high degree of uncertainty, due to information asymmetry that generates a lot of stress in customers.

Casavo has solved this problem by removing a step in the buying and selling process, initially positioning itself as a direct buyer through an “instant buy” service, purchasing a property and then finding a final buyer. “Over time, we have expandedour offer, and today sellers can either decide to sell directly to us or ask us to be connected to another buyer. Besides, we have also worked on the end-to-end experience on the buyer’s side: we don’t just stop at publishing an online catalogue, as typically happens, but we follow the customer through the whole process, from their mortgage request to the notary process, including all connected integrated services”, explained Tinacci. Casavo is a completely new service that shortens buying and selling time and bureaucracy.

Casavo’s encounter with P101

Casavo met P101 between 2020 and 2021, but the two companies had already been in contact for some time in the past. “As one of the main players in the venture capital market in Italy, we looked a lot at P101 even before our official partnership” – explained Tinacci, – “They have always looked with interest at the development of Casavo over the years, also because they have a particular inclination for the proptech market. Therefore, they decided to make an investment at the beginning of 2021, that was consolidated over time with other investments. In addition to this role of investor, P101 constantly participates in all strategic discussions for the development of the company and in the development of specific new projects.

Casavo’s competitors

Casavo does not have real competitors, especially in Italy, but there are players in the proptech sector who cover or try to cover assistance during the buying and selling phase with different or comparable solutions. In France, for example, there are some digital real estate agencies that try to simplify processes, or legacy players, such as real estate portals, with which Casavo has a relationship of coexistence instead of competition. Casavo is essentially unique, and the aspects that differentiate it from its competitors are various. For example, compared to a real estate agency, Casavo can directly buy properties and therefore offer an integrated platform that allows anybody to easily and transparently follow all the phases of the transaction. In the very long term, Casavo could be defined as a sort of “house e-commerce” that can assist customers in buying and selling, being able to provide all the ancillary services that may typically be needed during the sale, such as, for example, assistance in choosing the best mortgage offer on the market.

Casavo technology

Casavo’s ecosystem of products is based on specific elements that intertwine data analysis with technology and as asuch it makes the buying and selling process simpler and less stressful.

Casavo operates in a sector that is characterized by poor information transparency, where there is no single qualified and visible repository of all real estate transactions, therefore it is necessary to know how to read the data in order to correctly evaluate the properties and offer the best economic proposal. However, Casavo also aims to provide “educational contents” to facilitate the process of buying and selling properties through the correct information of all the parties involved.

The technological aspect is linked to everything that lies behind buying and selling operations, because buying a house is a very complex and articulated transaction, with processes that must necessarily take place live and others that can be managed from the platform. Over time, Casavo has built an integrated software architecture to ensure maximum scalability and efficiency of each activity in the value chain, which is reflected in an efficient, convenient and transparent buying and selling experience for customers.

Casavo’s User Experience

Casavo entered the market by providing a service that was tailored to the needs of property sellers, and then evolved by implementing its offer with other services on the buyer side. Using Casavo, sellers can follow all phases of the real estate transaction directly from the platform, via website or app. Each phase, from the evaluation of the property – and the specifications relating to the parameters of the the economic proposal – up to the sales agreement. Sellers can decide to accept Casavo’s offer , but they also have total visibility of buyers that might be interested in buying that type of property.

On the buyer’s side, through the platform users have access to a complete catalogue of properties and to a series of tools for an improved user experience. For example, thanks to a “real tour” technology, customers can view and visit the property directly from the platform, and this allows them to operate a sort of preliminary screening to evaluate which properties they’d like to visit. It is also possible to book a visit in just a few clicks.

Casavo also offers a series of auxiliary services to both parties, ranging from document management to mortgage consultancy up to after-sales assistance.

Casavo’s future

The company has 3 priorities for the near future: the first is to accelerate profitability and efficiency of operations according to a series of technological developments. The second is to accelerate the development of the marketplace, and therefore of the entire user experience on both the seller’s and buyer’s side. The third priority is to continue its integration in France, a market where Casavo entered last summer through the acquisition of another player. France represents the main real estate market in Europe and therefore, at the moment, the priority for the company is to focus on integrating its commercial offer in this country before entering new European markets.

A fundamental step for Casavo has been its long-term strategic partnership with Unicredit, signed at the end of 2022, after receiving a 10 million investment by the credit institution. This agreement consists of three features: to offer integrated services for Unicredit customers, to develop further innovations in the real estate sector, and to offer new solutions from a capital market perspective in the real estate sector.

Unguess is the first crowdsourcing platform for in-depth testing and research in the tech world in Italy. Founded in 2015 and initially named “AppQuality”, the start-up was born within the Cremona Centre of the Politecnico di Milano University, from the idea of three founders. Today Unguess is the first company in Italy that is based on the model of crowdsourcing, i.e., engaging communities of users and experts to test products on functional, quality, and security levels.

Currently, Unguess can reach a very large community of about 160 million testers around the world, who are hired to carry out in-depth research that results in different and more in-depth findings than those produced by typical market surveys.

The Evolution of Unguess

The purpose of Unguess “has always been to import and emphasize the value of quality of a digital product by reducing defects or bugs,” says Luca Manara, & CEO Co-founder of Unguess.

For this reason, they have launched the first crowdtesting community in Italy, based on millions of potential testers who are in charge of testing and directly reporting any problems they might encounter during use.

In the beginning, the platform only tested the functional side, as it grew, however, they started focusing on user experience and cybersecurity.

Currently, Unguess has three specific vertical department:

- Quality

- User Experience

- Cybersecurity

The role of P101

Unguess’s journey started in 2015 when the founders met Andrea Di Camillo and had the opportunity to describe the project idea they were working on. In P101, they found willingness to listen and a lot of advice to carry out their business strategy. The path evolved over the years, and in 2019 the founders got in touch with P101 again, laying the foundation for the growth of the project. “Close to the first round, the Covid pandemic exploded, but this did not stop their fundraising. In fact, in June 2020, we managed to close the first round entirely remotely,” says Luca Manara. In January 2023, again thanks to the support of P101, Unguess closed a 10 million euros second round.

Saas technology

The technology on which Unguess is based is more of a process. The platform has a SaaS approach, and its innovation lies in the engagement and gamification logics that allow it to engage many users in a short period of time and, therefore, to provide answers quickly. The SaaS logic also makes it possible to quickly implement all the insights we gather through the integration with third-party platforms (that customers already use), to which they integrate specific modules that are used to solve bugs swiftly. This type of technology allows for a highly profiled community, that responds in a very fast way and makes deep and articulated research, and it also allows Unguess to observe customers’ sentiment.

Target markets and differences with competitors

Unguess is the only solution of its kind in Italy. Iin Europe, there are others, but their offer is different from that of the Italian start-up. In fact, Unguess differs from competitors due to its horizontal approach to the various solutions: communities are developed in three vertical areas (Security, UX, and Functionality), but compared to competitors, Unguess manages to engage different types of communities per area, not only one-to-one vertically, but also transversally, obtaining deeper and more complete results and answers.

Unguess’s future

Currently, Unguess has 80 employees throughout the country and Europe. In the short term, they plan to enter important European markets, particularly France and Spain. Another goal in the short term is to keep developing their tech platform, in order to offer more and more tools to engage and extract insights from crowdtesting communities, to launch tests autonomously, and to increase integrations with bridging management tools.

Some specific facts about Unguess

One of the features of Unguess is its very remote-friendly policy, which allows anyone to work from wherever they want. Unguess also carries out hundreds of tests every month, and thanks to this philosophy, combined with its community of more than 160 million testers worldwide, it has reached approximately 300 enterprise customers globally, working in a variety of industries.

Cyber Guru is a company that offers cybersecurity awareness services, i.e., services to train end users who are not experts on the subject. The company aims to change the behaviour of end users so that they won’t become ‘allies of attackers’.

Cyber Guru’s growth over the years

The company was founded in 2017 because of a market need. On the one hand, 90% of cyber-attacks origins from a mistake that the end user unwittingly makes. On the other, the offers on the market at the time were largely unsatisfactory since they were very traditional learning courses, which were typically considered boring, too technical, unattractive, and complicated.

Cyber Guru was initially born within DaMan, a company owned by Gianni Baroni (who is now CEO of Cyberguru) that played the role of incubator for the first two years. They later realised that the investments needed to make a quantum leap were not within DaMan’s reach and turned to investors, in particular, to P101 and its partner Giuseppe Donvito.

Hence, in June 2021, the company closed its first investment round of € 3.6 mln thanks to which its turnover grew by 170% every 12 months for 2 years.

A second investment round is on its way.

To date, Cyber Guru has an ARR (Annual Recurring Revenue) of € 5 mln and 300 customers in 62 different countries.

Cyberguru’s unique technology

Cyber Guru’s technology is the result of a combination of two elements:

- The way content is developed: using the latest technology in e-learning and structural design so that content is highly engaging and effective for the end user;

- A highly automated platform that is based on machine learning and supports end-users by distributing various levels of informative content. Content is based on the level of knowledge each end-user demonstrates to have according to a specific risk: hard-skilled users will receive more sophisticated content, while low-skilled users will receive content that is more suitable to their background.

Cyber Guru’s competitors

In Italy, Cyber Guru has no competitors, it is in fact the largest centre of expertise in cybersecurity awareness, also thanks to the fact that it was the first to develop and use this type of technology. For this reason, it is also a partner of many big players such as Accenture, Boston Consulting Group, Deloitte, and Leonardo.

Approach with customers

Cyber Guru has managed to win customers of various kinds, from the largest Italian bank to small companies. Thus, it has an extremely diversified approach concerning the market both in terms of company size and market sector.

Plans for the future

Cyber Guru plans to expand in Europe, particularly in France, Spain, England, and Germany

WeSchool is an Ed-tech company that was born at the end of 2016. Their aim is to redesign teaching at schools, universities, and companies to make it more effective and engaging. During the Covid pandemic, when WeSchool was still very young, the awareness of their teaching model grew, and the company reached a community of over two million users. Now, post-Covid, the growth phase is in terms of turnover and head-count.

What is the value added that distinguishes WeSchool from its competitors?

Our value added is ‘Redesigning education’. It could mean a million things, but in our view, it implies a change of framework that is based on four specific pillars: what, who, how and when.

When we think of “what” we are teaching, we are comparing an old model to a new one. In the old model – which is still predominant today – online teaching means using a series of training materials and assessment methods via Web or App.

We believe this concept is rather boring. Our model is based on cooperative teaching, where browsing content makes up for only 30%-40% of the experience. The other part consists of research, discussion, and teamwork with other learners to solve problems, teach each other things, or put what you learned in previous classes into practice.

In short: at no point can learners turn their brain off, since they need to actively keep “doing”.

One very distinctive aspect of our model has to do with people: it’s the “who” pillar. In the old model, a class is made of one or more teachers and some students. In our model, there’s a teaching team made up of instructional designers, teaching assistants who help with tutoring and group work, community moderators who engage and manage day-by-day learning communities, and a creative team that consists of motion & graphic designers, copywriters and videomakers. This requires working in mixed teams, which might be more expensive, but the results are unbeatable when compared to the old model.

Let’s now move to the “how”: in the old model, when people are in a live class (in person), they

are in a group and usually don’t use any technology. On the other hand, when people are working remotely or e-learning, they are “alone,” but using technology. In WeSchool, we believe in an alternative: technology must be used both in person and remotely with a single goal, no matter the context: fostering interaction and collaboration. We offer a whole series of features to use technology in a useful way. Whether users are face-to-face or remote, they are always part of a community and won’t feel that they are working or studying by themselves.

Finally, “when”: In the old e-learning model, you can connect whenever you want and

take lessons whenever you want. However, a model with no common timetable and deadlines does not foster collaboration and participation, resulting in poor retention rates. Our approach, developed back in 2018 and which has increasingly been known as the “bootcamp” or “cohort based” model, is different: we work in “classes,” and there are deadlines to each social learning activity.

What is the technology behind WeSchool?

From a technological point of view, WeSchool is the opposite of an LMS: instead of a platform that delivers content with social features, WeSchool is a community management and collaboration platform with learning management and content delivery features. Social learning is not a frill: it’s the substance. That’s because WeSchool is a synthesis of two souls: a combination which makes us much different from other EdTech companies. Half of our team has a background in humanities – and they are the people working in teaching and instructional design – and the other half have a tech background.

How did WeSchool meet P101?

I have known Andrea Di Camillo for many years, since the Italian startup scene was as big as my grandmother’s living room. During the Covid years, we were lucky enough to get to choose who we wanted to let into our capital, and we chose P101 for their professionalism, as well as the “feeling” we had, which I believe is a very important factor in the VC-entrepreneur relationship. We collected €6.4 million in our “Series A” round, which was led by P101 and joined by TIM, CDP Ventures, Club Italia Investimenti and Club Digitale.

Further info about WeSchool

Since its first round, WeSchool has doubled its growth year after year, achieving a revenue of €700,000 in 2020, €1.8 million in 2021, and €3 million in 2022. Currently, WeSchool employs 68 people across Europe, mainly in Italy, Spain, and Greece. Their next focus is to increase international turnover in order to grow even faster.

What is WeSchool’s business model and who are its top customers?

WeSchool’s turnover is mostly generated in two ways: the first is selling the use of its platform, and the second is selling Educational Projects and our teaching model, both to companies and schools. Top customers are both small companies and large corporations, including Amazon, IKEA, Intesa Sanpaolo, JP Morgan, Luxottica, NIKE, Qualcomm, and Vodafone.

What are WeSchool future goals?

Conquer the world, always! And then, as my colleague Luca would say: ‘make it to Christmas in one piece’.

Velasca is an Italian company that has been progressively establishing itself as a reference point for those who look for high-quality handcrafted footwear and clothes.

Its history started in 2013 from the idea of two Italian entrepreneurs, Enrico Casati and Jacopo Sebastio.

They developed their project focusing on “Made in Italy” and “creating a modern company and brand that could combine the Italian artisan tradition and an innovative direct sale model”.

“We wanted to differentiate our company from competitors by becoming the architects of a full craftsmanship rebirth“, the two founders explained. “In the past, this activity was one of the centres of the Italian industry. Recently, it has been considerably penalised by the spreading of industrial production“.

The first step Casati and Sebastio took to build their business was to travel across Italy, looking for the perfect shoemaking district. They found it in Montegranaro, a town in Marche, famous for shoe production.

From then on, they have kept working with those local realities. Furthermore, Velasca constantly exchanges views with those artisans to develop their models. And those professionals provide their expertise on various matters, from the sketches for new models to the selection of materials.

The evolution of Velasca

In the beginning, Velasca was a little e-commerce reality. Their first order only comprehended 125 pairs of moccasins.

However, they soon managed to open their first store in Milan. Nowadays, they count 18 shops, “Le Botteghe”. Fifteen stores are in Italy (Milano, Bologna, Roma, Firenze, Brescia, Napoli, and Palermo), while other three are in New York City, Paris, and London.

In addition, Velasca put a great effort into consolidating its position in the international market. Nowadays, its business consists of international deliveries for 40%. Their primary markets are France, the USA, the UK, Germany, and Denmark.

Together with this international expansion, there have been other substantial changes.

In 2021, the company released its first women’s footwear collection, “Velasca Woman”, which was always produced by the same artisans from Marche. Over the same year, they opened their first Velasca Woman store, and by the end of 2022, they had two further shops in Rome and Torino.

Furthermore, in October 2022, they launched their first menswear collection.

Since its early stage, Velasca has been attracting the interest of several investors. In 2014, the company joined the startup accelerator “Boox”. Between 2018 and 2019, they secured two substantial investment rounds of 2,5 and 4,5 million euros. The first one had P101 as lead investor, while the second had Milano Investment Partner (MIP).

Clients always come first

Velasca has always prioritised direct contact with clients and avoided all the intermediaries of the classical supply chain. This makes it easier to provide competitive prices and high-quality products. It also allows the company to get fast and constant feedback. Finally, this work modality results in a more efficient customer experience.

Attention to the client also means that, since the beginning, the company has been focusing on logistics. Furthermore, they have always provided free returns for orders made from the EU and North America.

Technology

Since its foundation, Velasca has been looking for and employing the latest technologies for its digital communication (online presence, CRM system, social media, and interactions with customers) and its e-commerce system.

For what concerns the latter, they have always aimed to reach a full automation of their process. Furthermore, the company employs business analytics tools like “Domo”.

Velasca sometimes develops new technologies, as well. For instance, they built a high-precision software that tracks packages during the entire delivery process. This tool directly provides Velasca with updates. Then, the company notifies the client. Velasca was one of the first companies to use a similar system.

Velasca’s future

Velasca aims to reach a revenue of 70 million dollars by 2025. Moreover, they want to increase the number of physical stores to 30 by the same year. They are planning to open the majority of them outside Italy.

In addition, Velasca is monitoring what is happening with augmented reality. They are particularly interested in the developing technologies that will allow to see a pair of shoes on your feet while shopping in a virtual store. Potentially, that image will come along also with advice for the size. These tools will be fully functional over the next few years.

Finally, during the pandemic, the balance between offline and online sales had a huge shift in favour of the latter. In 2022, Velasca managed to re-establish that equilibrium. However, they are working so that the ratio becomes 60 to 40 for online sales.

Multiply Labs is a company that aims to accelerate the production of individualised and advanced medicines and transform it into an industrial process. To achieve that, they are focusing on robotic technologies and automation.

The company was founded in 2016.

It all started with Alice Melocchi, who, at that time, was a researcher in the field of advanced drugs production. She was looking for a way to accelerate and scale the entire process. She was also considering technologies from different realms, from engineering to chemistry.

One day she contacted a friend of hers – Fred Parietti, soon-to-be co-founder and CEO of Multiply Labs – to go and see his laboratory. Parietti was a mechanical engineering student at MIT. He was working on a robot, a project for which he was employing innovative technologies like 3D printing.

“Alice was interested in my work because I could create prototypes swiftly, which is something unusual for the pharmaceutical industry“, said Parietti.

Soon the two future entrepreneurs fully understood the potential of robotic technology: it can improve the medicine production process. In addition, it allows to manufacture individualised products.

Parietti explained: “In that moment, the idea behind Multiply Labs was born. We decided to create robotic technologies for pharmaceutical companies that enabled them to produce advanced drugs more efficiently and on a vast scale. Until then, that process was fully handmade, especially in the case of biological or cellular therapies“.

A substantial growth

Over the last few years, Multiply Labs has obtained significant revenues, even while the company was still growing, which is something quite unusual in the pharmaceutical industry . They have also managed to build a great network of co-workers that has reached, today, almost 40 employees.

In April 2021, the company was the protagonist of a significant investment. They raised $20 million in a Series A financing round led by Casdin Capital.

Multiply Labs’s clients

Multiply Labs’s business is not addressed at start-ups or SMEs but at big companies. Among its clients are some of the most prominent realities in the pharmaceutical industry, like Thermo Fisher Scientific.

These companies already employ robots which are compatible with Multiply Labs’s features. And this is what makes these work relationships successful.

Over the years, Multiply Labs has evolved into an international company, with employees in the east and west coasts of the United States and in China, in the city of Shanghai.

Indeed, Multiply Labs has developed partnerships with American and Chinese companies.

Multiply Labs’s technology

The most important and appealing aspect of Multiply Labs’s technology is the approach with which is developed. It is also what makes the company stand out from its competitors.

Multiply Labs has built features that can be easily integrated with companies’ tools and processes that, therefore, do not need to be modified.

“We use robotic systems. We also train robots to deal with pre-existing tools. Instruments that, nowadays, are used manually (for example, incubators). Therefore, we add automation to existing processes. We do not replace them. We are the only ones to do it”, underlined Parietti.

Almost all their competitors operate differently. They build machines and tools that work with new systems. Therefore, clients need to adopt new working methods to use them. This can be very challenging, expensive and time-consuming. And it can bring about several technical issues, especially for pharmaceutical companies. For instance, introducing a new environment or nutrient alters the entire process if cells are involved.

Next steps

Last December, Multiply Labs secured a partnership with a leader company in the Chinese pharmaceutical industry. Then, they took some of their robots to a factory in Shanghai. These robots will produce drugs (capsules) following FDA‘s regulations.

Moreover, Multiply Labs has built a new generation of robots that cultivate cellular therapies. They are carrying on this programme at the University of California in San Francisco.

These advanced robots are also at the centre of a new project. Multiply Labs wants to use them to produce cellular therapies at a commercial level. The company is working to finalise these robots, which are currently in their prototype stage.

Soplaya is an Italian company that has been working on optimizing and speeding up the supply chain of the restaurant industry.

The start-up was born in 2017 in Friuli Venezia Giulia (in the northeast of Italy).

Over its first four years of activity, the company has created a network of clients in ten different cities across the northeast of Italy. Then, in 2022, they further expanded their business in the north and centre of the country.

All this happened with the support by P101, that helped Soplaya secure new investors and keep investing. P101 also offered its support for complex business choices and work management.

Everything began by examining the main problems in the restaurant industry

Soplaya founders – Mauro Germani, Gian Carlo Cesarin, Ivan Litsvinenka and Davide Marchesi – started developing their business by analysing their previous experiences. Indeed, at that time, they had already worked in various areas of the restaurant industry.

“Thanks to our network of restaurants, we had already understood a lot about the sector. For instance, we knew that supply management was very complicated and not always transparent and efficient. And this problem involved every aspect of this process, from looking for new manufacturers and suppliers to delivery“, Germani said.

The four entrepreneurs wanted a deeper understanding of the field. Therefore, they talked with hundreds of other restaurants from all over Italy and other countries. This allowed them to “really discover what happens on the other side of the production chain”.

This search highlighted a few relevant problems. In January, vendors need to establish a fixed price for their products. A price that, later on, can turn out to be insufficient to cover all their costs.

Another relevant issue is the length of the distribution chain. It can bring about difficulties for both restaurateurs and manufacturers. In fact, because of this system, Manufacturers’ revenues become more and more narrow. Furthermore, they often receive their payments after a long time (60, 90 days, or even more). On the other hand, restaurateurs do not find suppliers easily. In addition, it can be difficult for them to figure out the actual price of what they want to purchase. Indeed, it is not uncommon to find massive differences in the cost of a product.

Recently, the situation has become even more complex as raw materials have become increasingly expensive. Also, the food service sector has lost 150-200 thousand employees since the beginning of the Covid pandemic. Thus, restaurants find it more and more arduous to keep up with their schedule. Also, energy is getting pricier than ever.

To face this situation, manufacturers and restaurateurs have two choices: lowering the quality of their products or shortening their supply chain. Therefore, manufacturers are often starting their sales or distribution networks. While restaurateurs are directly addressing manufacturers for their purchases. Nevertheless, becoming independent means more costs in terms of time and money for both of them.

“Soplaya is born to sort all these problems out”, Germani explained. “We shorten the distance between manufacturers and restaurateurs. We create direct connections and support these connections with a full automation of the production chain and a very efficient logistic system”.

Soplaya’s technological tools

In 2021, Soplaya created an essential element of its technological apparatus: an app that allows restaurateurs to manage the provisions of their restaurants.

On this platform, users can:

- find new products with the help of machine learning, that can show products that match a client’s needs in a short amount of time.

- accelerate the management of provisions to up to 2 hours every day. Indee, the app and several other tools allow unified payment and BNPL. There is also an additional tool that speeds up the request for samples.

Furthermore, Soplaya has created a system that allows to notify the delivery time to the minute. And, 99,5% of the time, their courier abide to the 2 hours’ time window that the client chooses. The company has also developed features that will allow a complete automation of the production chain, from the delivery process to the management of vendors and prices.

Thanks to all this, the company is playing a role in making the restaurant industry more sustainable: the operations managed with Soplaya’s tools result in low food waste (0.1%). In addition, since they group more deliveries together and employ reusable packaging, they cut CO2 emissions by 50%.

Soplaya and its future

Soplaya aspires to reach a complete automation of the production chain. To do this, they need to introduce machine learning in warehouse operations. Thanks to this, it would be possible to automatically handle demand (restaurants) and supply (manufacturers) and connect the best matches. This would also allow the company to deal with more products and, at the same time, to keep food waste low. Finally, deliveries would remain extremely fast and precise.

The company also desires to strengthen its business presence in the north and centre of Italy. Furthermore, they are planning to work on their BNPL solution to allow automated payments within 30 days.

Finally, Soplaya aims to make restaurant operations fully automatic. They are developing a “premium service” that will comprehend several logistic features and technological tools.