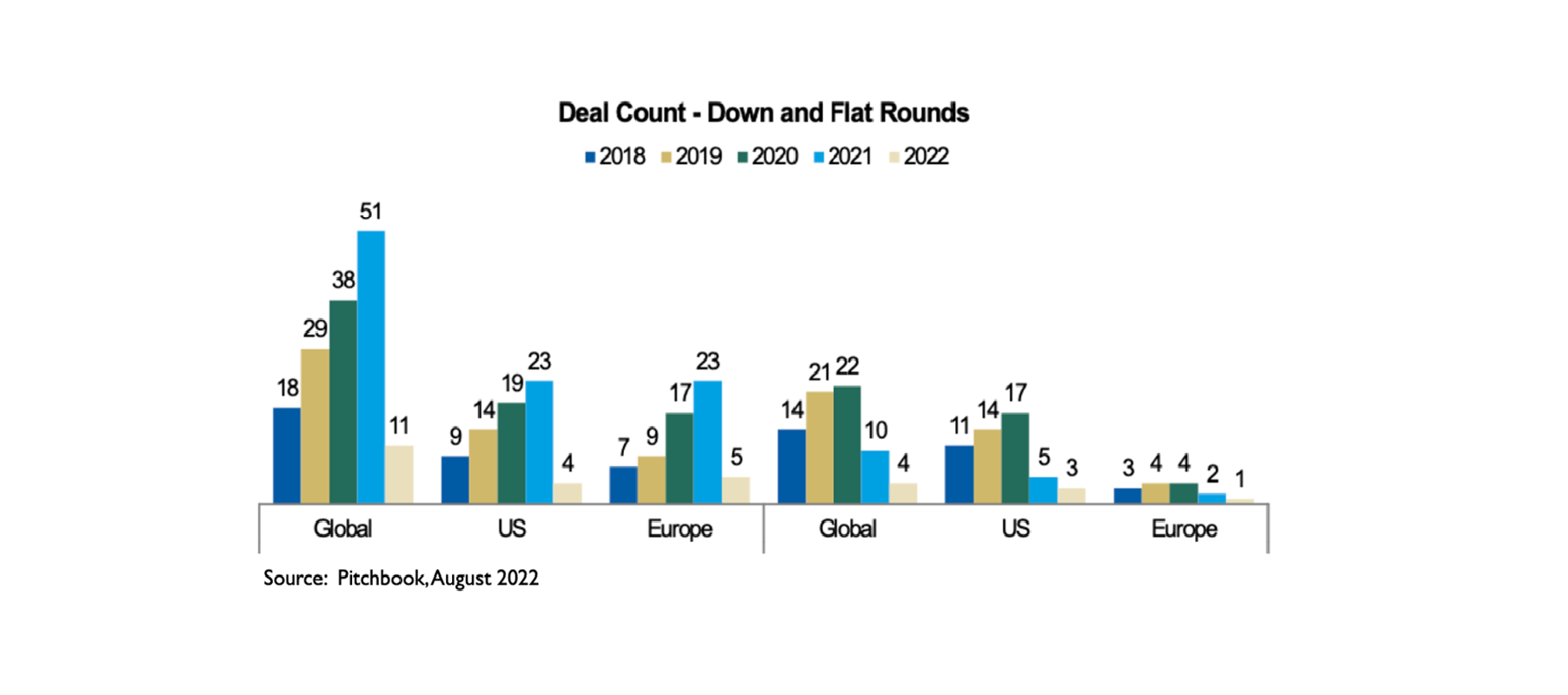

2022 could not be a good year for Fintech in Europe… but it could be worse. In fact, despite some big down rounds, such as Klarna’s, only few down or flat rounds have been counted to date:

What is next?

According to Morgan Stanley’s analysts, private markets usually suffer from public downturns 18 months later, on average, and therefore a trough in valuations is expected to show in July 2023.

Hence, private markets may have 10 further months of downturns or smaller funding rounds ahead, as VCs will become more selective, and founders won’t raise dilutive rounds.

On the other hand, there is a lot of dry powder (aka money) that must be somehow allocated especially by all the funds that have raised money in the last 10 months and that have decided to slow their investments down to see what turn the macroeconomic scenario will take. But if Morgan Stanley’s analysis is true, which is likely, these funds cannot wait 18 months and then start investing massively: they would not respect their investment period schedule (agreed with the LPs) since they would not have the time to make the necessary money deployment.

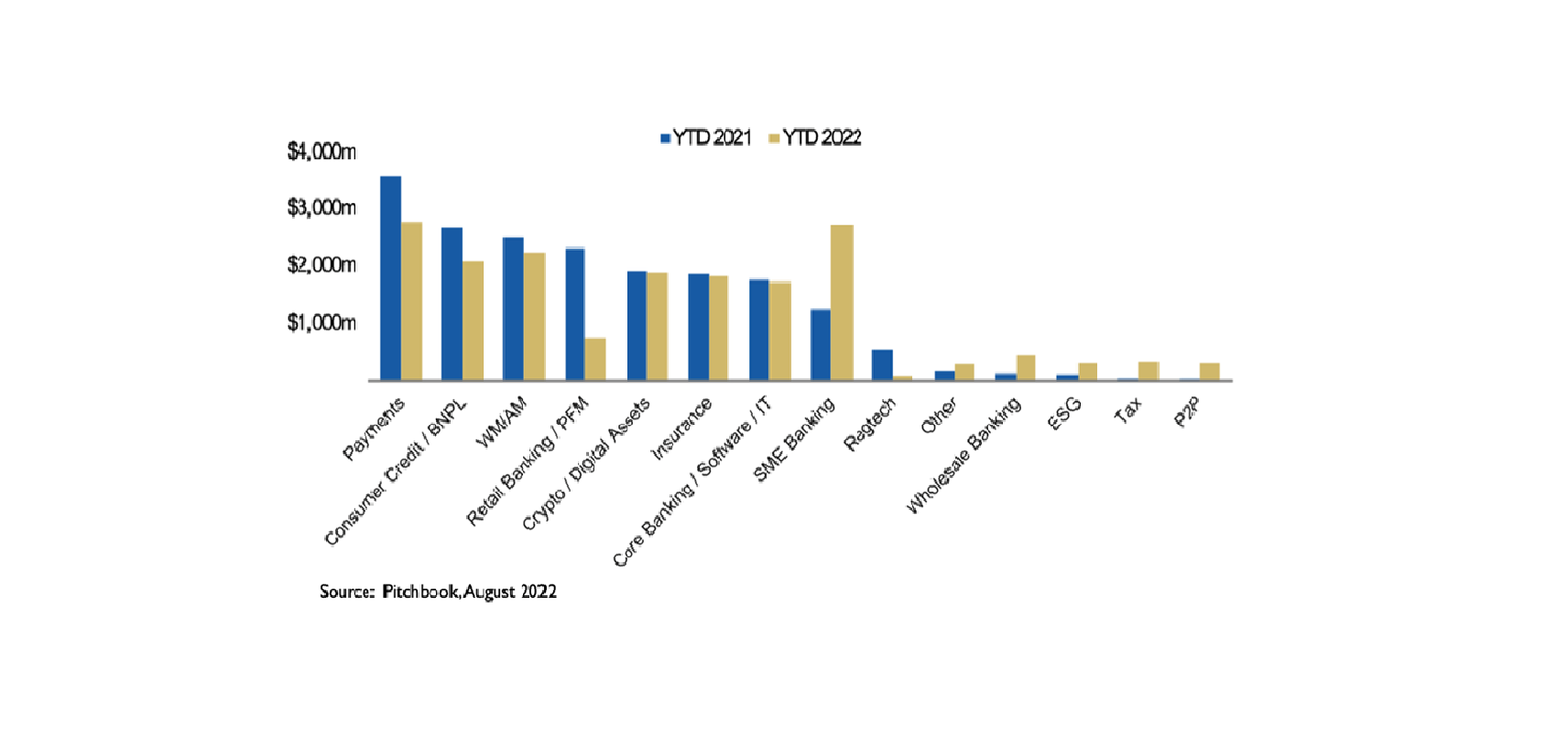

Where can VCs invest?

As a fund, we must understand and intercept future trends, analyzing fintech sectors that are currently overperforming the industry, despite all the macroeconomic scenarios:

SME Banking is the sector that has seen the most increase in funding in 2022, by far. Payments is still something hot as BNPL, but less than in 2021.

Why invest?

More and more SMEs are looking into embedded finance to decrease frictions with incumbent banks. According to a 2021 research by Accenture, based on a panel of more than 2,5k SMEs around the globe (especially Europe and the US):

- 41% of SMEs would be interested in using banking services from a digital service provider. A percentage that reaches 52% as businesses get larger (50-250 employees);

- 44% of SMEs prefer digital platforms to offer services in partnership with traditional banks. A number that falls to 30% as businesses get larger;

- 47% of SMEs would be willing to consider a premium price for embedded finance services. A portion that grows to 57% as businesses get larger.

It will be more and more fundamental for companies to get an extra revenue line (brokerage margin) by providing financial services to their supply chains, as if they were a bank. In this way they could increase margins and allow suppliers to be financed, for example, through plain lending or advance invoices, with interest rates that are currently just a few basis points above banking ones, helping them to overcome turmoils in a faster and simpler way.

For instance, among our portfolio companies is a leading embedded finance player, Opyn. This company is known for offering Banking as a Service (BaaS) products and supply chain finance. It gives SMEs a complete suite of tools from which they could both borrow money and also be lenders, according to their needs.

AI platforms and Saas business

Besides AI platforms that speed the credit process up and are super-interesting opportunities for SMEs, there are other fintech spaces for SMEs leading us into temptation, i.e., SaaS businesses:

- Risk management tools: so far there’s nothing for SMEs that could resemble a risk management function, as the one that all VC funds must have, with the result that lots of companies don’t know who they are working with, its financial stability, etc… with all the implications;

- Cybersecurity solutions that deal with fraud prevention & biometric access and protection;

- Tools for improving Financial Institutions’ KYC procedures.

Financial Institutions love SaaS and AI Fintech businesses because they have these features:

- Cost Savings: no hardware equipment updates, no installations or traditional licensing burden;

- No need for internal team: responsibility of the SaaS provider;

- Many value-added services: issuing and acquiring integrations have already been done;

- Regular updates: which will translate as a continuous stream of innovation to the members of the ecosystem;

- International profile: easy to deploy wherever its needed and in real-time, easy overcoming cross-border problems;

- Always on track with the newest technological trends;

- High and automated security controls;

- Agility to support volatile business cycles and demand patterns.

Both SMEs banking and Embedded Finance are trends that we believe will grow much stronger in the near future: fintech companies that will provide the technology to fill these gaps will probably be unicorns in a few years.

Sources:

“Embedded finance for SMEs: the ultimate collaboration of banks and digital platforms” – Accenture 2021 (research on +2,5k interviews of SMEs in Italy, France, Germany, Spain, UK, US, Canada, Singapore, Australia, Brasil);

“The Fintech radar – Private versus Public markets, diverging trends” – Morgan Stanley, August 2022

Pitchbook, August 2022.

1000Farmacie is specialised in the home delivery of OTC medicine and drugs, which are those that do not need a prescription. Its system is based on a network of Italian pharmacies that make their products available on its platform.

The mind behind the entire project is a young entrepreneur, 29-years-old Nicolò Petrone. Before becoming CE0 of 1000Farmacie, he had founded Medici, a fintech marketplace that the American company Prove acquired in 2021.

Petrone created his new start-up together with two other entrepreneurs, Mohamed Younes and Alberto Marchetti.

Firstly, 1000Farmacie closed a 1.7-million-dollars round. Then, in February 2022, the company announced that its capital had increased by 15 million dollars. P101 SGR e HBM Healthcare Investments were the lead investors of the entire operation. Corisol Holding, Club degli Investitori, IAG, LIFTT and Healthware Ventures also invested in this new business.

1000Farmacie has reached a gross merchandise value of over 20 million dollars, on a yearly basis. Also, it keeps on reinforcing its partnerships with some of the major pharmaceutical companies in Italy. These companies chose 1000Farmacie to improve their delivery service.

1000Farmacie launched its business during the peak of the Covid pandemic

The story of 1000Farmacie began in March 2020. Petrone started developing an idea he’d had while living in the USA. He had moved there after his graduation in Economy at the University “Federico II” of Naples. In the USA, he had attended the Hult Business School in San Francisco.

That Petrone started thinking about e-commerce in the pharmaceutical sector when he was living in the USA is no coincidence, as the digital health market was already very developed there. According to him, the fact that in the USA they can sell prescription drugs online – an option that is still not available in Italy – helped this sector progress greatly.

However, the pharmaceutical business was becoming increasingly important in the European Union as well. And this, of course, was a pivotal element in the creation of the start-up. “In Europe, the pharmaceutical business had been growing massively, and we decided to enter the market”, explains Petrone.

While developing their new business, Petrone and his two associates considered another aspect. The Italian pharmaceutical market is very fragmented. It is characterised by independent pharmacies with no online platforms where they can sell their products. Furthermore, each of them has a limited variety of products.

Therefore, 1000Farmacie introduced to the Italian market a system that makes the inventories of many pharmacies available on a single platform. Thanks to that, it provides clients with a greater variety of products and a faster home delivery.

Over the last year, 1000Farmacie’s gross merchandise value has increased by 300%. Since its establishment, the company has formed a network of more than 100 independent pharmacies. Nowadays, 290,000 customers are using the platform, where they can choose amongst 95,000 products.

How does 1000Farmacie work?

When they were developing their start-up, Petrone, Younes and Marchetti understood that there were two business models they could employ. One was a pharmacy with stocks and a storage room. The other was something similar to a marketplace. They chose the second one.

“In the e-commerce business, costs related to logistics have a huge influence”, says Petrone. “Working with a pool of pharmacies involves fewer expenses because you rely on their logistics. This model becomes scalable, and it nullifies the risk of having unsold goods or products that are about to expire. On the other hand, you can still have an ample catalogue”.

“We have created a vertical integration with the pharmacies’ managements. It has been a complex process because the market is very diverse”, he adds.

Anyway, not every pharmacy is suitable for this type of business. “Our pharmacies need to have a wide workforce, since the amount of work may increase abruptly, and they might need more people and space right away to meet market needs”, explains Petrone.

Next steps

1000Farmacie is planning to expand its market. Until now, it has only worked in Italy, but the idea is to start new partnerships in other European countries too.

The company also wants to improve the e-commerce side of its business. Their aim is to speed up delivery times. In a few months, the start-up will activate a service that will guarantee delivery within 24 hours. In the beginning, this option will be available in the major Italian cities, then nationwide.

The new funds will be used specifically for the technological and commercial improvement of 1000Farmacie’s platform. This process will focus on finalising an innovative model for the online sale of pharmaceutical products.

1000Farmacie will develop in a similar way to Pillpack, the US company that Amazon bought for 1 billion dollars in 2018, in order to integrate its technology. In fact, Pillpack has developed an e-commerce business of pre-dosed and sorted meds. Before that, Amazon only sold OTC drugs.

Last but not least, 1000Farmacie will also introduce new services. For example, from 2023, clients will be able to ask for health support through its platform.

Partnership Strengthens Musixmatch’s Position in Growing Market and Drives Creator-Centric Expansion Opportunities in New Geographies and Verticals

Bologna, Italy; San Francisco, CA – July 27, 2022 – Musixmatch, a leading global music data platform, today announced a significant investment from TPG, a leading global alternative asset management firm. TPG is making its investment through TPG Growth, the firm’s middle market and growth equity platform. The partnership with TPG advances Musixmatch’s mission to provide lyrical content, tools, enriched metadata, and services to a growing community, while expanding its offerings internationally and in new verticals.

Since the company’s founding in 2010, Musixmatch has assembled the world’s largest lyrics catalogue, while bolstering its capabilities and identifying new use cases for lyrics. With lyrical content for millions of songs across 80+ languages, Musixmatch provides its metadata to digital service providers (DSPs), including Amazon Music, Apple Music, Google, Instagram, Spotify, and Tidal. The content is generated and continuously updated by a global community of more than 20 million curators, a sophisticated artificial intelligence / machine learning technology stack, a network of more than a million verified artists, and a team of in-house trained quality assurance specialists. The company has relationships with more than 100,000 music publishers globally, including BMG, Kobalt, Sony Music Publishing, Universal Music Publishing, and Warner Chappell.

“Over the past decade, our team has built Musixmatch from the ground up with a vision to better represent songwriters and artists, allowing their lyrics to reach a global community of music lovers,” said Musixmatch Founder and CEO Max Ciociola. “The team at TPG brings more than just deep experience investing behind world-class music and streaming companies – they also share our ethos and the entrepreneurial spirit that has been a hallmark of our success to date and will continue to drive our next phase of growth. We are thrilled to welcome TPG as a partner and look forward to what we can bring to our artists and their fans.”

“Digital music streaming has become the default form of music consumption and continues to experience robust growth,” said Jacqui Hawwa, a Business Unit Partner at TPG Growth. “We have long admired the impressive platform that Max and his team have built and believe Musixmatch’s unparalleled metadata catalogue, proprietary lyrics sourcing engine, and extensive relationships with streaming platforms and IP owners will continue to position the company for success in this large and growing market.”

TPG has significant experience investing in music and streaming and has an extensive portfolio of music and broader media investments including Calm, Creative Artists Agency (CAA), DirecTV, Entertainment Partners, Fandom, and Spotify.

Citi acted as financial advisor to Musixmatch, Legance served as legal counsel, and Tremonti Romagnoli Piccardi & Associates and Goodwin assisted management on this transaction. Ropes & Gray and Chiomenti served as TPG’s legal counsel.

About Musixmatch

Founded in 2010 in Bologna, Italy by Max Ciociola, Giuseppe Costantino, Gianluca Delli Carri, Francesco Delfino, and Loreto Parisi and backed by Micheli Associati, P101 Venture, and United Venture,

Musixmatch features the world’s largest lyrics metadata collection, enhanced by additional metadata across 80+ languages. Today, Musixmatch has more than 120 employees across Italy and Europe.

About TPG

TPG is a leading global alternative asset management firm founded in San Francisco in 1992 with $120 billion of assets under management and investment and operational teams in 12 offices globally. TPG invests across five multi-product platforms: Capital, Growth, Impact, Real Estate, and Market Solutions and our unique strategy is driven by collaboration, innovation, and inclusion. Our teams combine deep product and sector experience with broad capabilities and expertise to develop differentiated insights and add value for our fund investors, portfolio companies, management teams, and communities.

- Casavo raccoglie 100 milioni di euro nel round di investimento Serie D guidato da Exor, si tratta del più grande finanziamento di sempre nel settore PropTech in Europa

- La società si è inoltre assicurata ulteriori linee di credito di 300 milioni di euro da parte di Intesa Sanpaolo, Viola Credit e altri importanti istituti di credito

- Casavo mira a estendere la propria leadership di settore in Europa continuando a sviluppare la propria piattaforma ed espandendosi in nuovi mercati

Milano, 19 luglio 2022 – Casavo, la piattaforma PropTech europea leader di mercato che sta ridisegnando l’esperienza di chi vende e compra casa, annuncia oggi una raccolta di capitale da 400 milioni di euro.

Questo round di finanziamento Serie D da 100 milioni di euro dimostra i solidi fondamentali del business e ne conferma le prospettive di crescita nonostante le difficili condizioni nel mercato dei capitali. Le ulteriori linee di credito di 300 milioni di euro aumentano a oltre 500 milioni di euro i capitali per scalare l’attività di acquisizione immobiliare per i prossimi anni.

Numerosi gli investitori coinvolti

Il round di finanziamento è stato guidato da Exor NV. Tra i nuovi investitori figurano, tra gli altri, Neva SGR (Gruppo Intesa Sanpaolo), Endeavor Catalyst, Hambro Perks, Fuse Ventures Partners, oltre a angel investor come Sébastien de Lafond (fondatore di MeilleursAgents). L’insieme degli investitori coinvolti fornisce un mix di competenze strategiche per supportare la crescita futura dell’azienda. Tutti i principali investitori attuali tra cui Greenoaks, Project A Ventures, 360 Capital, P101 SGR, Picus Capital e Bonsai Partners hanno partecipato al round di investimento Serie D.

“Siamo felici di rafforzare la nostra relazione con Exor dopo il loro investimento iniziale dello scorso anno, e di dare il benvenuto a tutti i nuovi investitori a fianco dei nostri attuali azionisti” afferma Giorgio Tinacci, Fondatore e CEO di Casavo. “Questa operazione straordinaria è il riconoscimento della nostra continua attenzione alla crescita sostenibile e della nostra strategia di lungo termine. Questo round ci consentirà di consolidare la nostra leadership in Europa attraverso ulteriore crescita in Italia, Spagna e Portogallo, e ci permetterà di espandere il nostro business in nuovi mercati, con la Francia come priorità. Continueremo a investire nella nostra missione di semplificare il modo in cui le persone vendono e comprano casa, proseguendo il percorso di evoluzione da Instant Buyer a marketplace residenziale di nuova generazione“.

“Casavo sta diventando leader indiscusso in Europa nel settore PropTech e siamo entusiasti di continuare il viaggio con Giorgio. Nonostante le turbolente condizioni del mercato, il team ha lavorato molto bene fino a oggi e siamo ottimisti per il futuro“, ha affermato Noam Ohana, Managing Director di Exor Seeds.

Accesso al capitale ad un costo ridotto

L’ulteriore finanziamento asset-backed di 300 milioni di euro include un’estensione di 190 milioni di euro della principale linea di credito di Casavo, a sostegno dell’espansione in altre aree geografiche. L’operazione ha visto la partecipazione di nuovi finanziatori, tra i quali Intesa Sanpaolo (IMI Corporate & Investment Banking Division), che si uniscono alla compagine attuale composta da Goldman Sachs e D.E. Shaw & Co. Il finanziamento prevede una significativa riduzione del costo del capitale. La fiducia dimostrata dagli investitori conferma la solidità del modello di business di Casavo.

Una piattaforma integrata per chi vende e acquista casa

Fin dalla sua fondazione nel 2017, Casavo è stata guidata da una visione chiara: rimuovere le complessità tipiche della compravendita immobiliare. Casavo è nata come piattaforma per l’acquisto diretto di case, con un modello di business noto come “Instant Buying”, ed è diventata il punto di riferimento online per la maggior parte dei venditori grazie a un servizio veloce e trasparente, a differenza del processo tradizionale.

Sfruttando la sua tecnologia proprietaria, l’azienda si è poi evoluta in un marketplace innovativo, dove i proprietari di casa possono iniziare il processo di vendita o di acquisto con il pieno supporto di Casavo in ogni fase. Ad oggi, Casavo ha eseguito transazioni per oltre 1 miliardo di euro.

I venditori possono ricevere un’offerta di acquisto direttamente da Casavo, oppure trovare l’acquirente perfetto sul mercato grazie alla rete di agenzie partner. Gli acquirenti hanno accesso a una selezione di immobili “pronti per essere abitati”, integrata a un’esperienza utente curata e a servizi complementari come Casavo Mutui. La piattaforma di Casavo mette inoltre in contatto gli operatori del settore immobiliare, tra cui agenzie immobiliari, banche e società di ristrutturazione, generando valore per tutti gli attori dell’ecosistema.

Casavo è la piattaforma digitale per il mercato residenziale che sta ridisegnando l’esperienza di chi vende e compra casa in Europa attraverso l’utilizzo della tecnologia in ogni fase del processo di compravendita. Casavo aiuta chiunque voglia vendere o comprare casa a farlo in maniera semplice, veloce e vantaggiosa, fornendo la soluzione più adatta alle esigenze di ognuno. Casavo offre servizi integrati dedicati alla casa e un’esperienza chiavi in mano, anche grazie al modello inclusivo sviluppato per collaborare stabilmente con i principali operatori del mercato (agenzie immobiliari, imprese di ristrutturazione e banche). Fondata nel 2017 da Giorgio Tinacci, Casavo opera attualmente in Italia (Milano, Roma, Torino, Firenze e Bologna), Spagna (Madrid, Barcellona, Malaga e Siviglia) e Portogallo (Lisbona), e si sta rapidamente espandendo in nuovi mercati europei, grazie a un team internazionale di oltre 450 persone e al supporto di investitori a livello globale. Per maggiori informazioni, www.casavo.com

Now!PR | Ufficio stampa

Mattia Zanetti – mattiaz@nowpr.it | +39 335 7576144 Sara Di Betta – sarad@nowpr.it | + 39 333 6573395

Santa Cruz de Tenerife, March 10, 2022. – The online check-in software for hotels and hotel chains, Civitfun Hospitality, has closed a €2,000,000 investment round led by P101 SGR, the Italian venture capital firm that invests in digital and technology companies in Europe, that has already also bet on other Spanish startups.

In this investment round, Civitfun Hospitality brings in Claudio Bellinzona and Fabio Zecchini as advisors, both founders of the startup Musement, which was also owned by P101 SGR and was acquired in 2018 by the travel giant TUI. In addition, Claudio Bellinzona joins the Board of Directors of Civitfun Hospitality.

As a result of this investment, Civitfun Hospitality will expand its team to 50 employees, including sales representatives and engineers. They will also strengthen their current team to simultaneously continue develop various areas within the company (IT, product, project manager, customer service, marketing, and sales). Furthermore, the company intends to consolidate its leading position in Spain and initiate its international expansion in Europe.

This capital increase will be dedicated to improving the Civitfun Hospitality product, with a focus on increasing automation and boosting marketing efforts on a recently launched product: Civitfun Hub.

This revolutionary product removes many of the barriers that currently exist in the tourism sector and allows any tourism company (OTAs, tour operators, booking engines, chatbots or apps, among others) to integrate their own online check-in with the main PMS (Property Management System) through a single integration with the Civitfun Hub API. Currently, different online agencies such as Booking.com, leading European tour operators and other companies in the travel sector are already using this integration, and such these agreements in place, Civitfun Hospitality aims to grow by more than 2,000,000 new hotel rooms by 2022.

The new post-pandemic tourist shows new behavioral habits. These changing trends have resulted, among other things, in increased demand for the digitization of travel services and hotel check-ins. This change has prompted many travel companies, such as online agencies and tour operators, to integrate with Civitfun Hub to digitize guest check-in.

Currently, over 250,000 rooms are using the Civitfun Hospitality online check-in solution in over 20 countries around the world. Moreover, many of the main Spanish hotel chains have chosen Civitfun Hospitality as their official supplier to automate online check-in at their hotels.

Some success stories include Barceló Hotel Group, Catalonia Hotels & Resorts, the Lopesan Group, Ilunion Hotels, Sirenis Hotels & Resorts, Garden Hotels, PortAventura Hotels, Karisma Hotels & Resorts, among many others.

In 2020, at the height of the COVID-19 pandemic, Civitfun Hospitality increased its turnover by 180%. This increase took place in just 6 months as hotels needed an online check-in solution to comply with anti-COVID protocols, and Civitfun Hospitality has been leading the Spanish market since 2016. This growth continued in 2021 with a 200% increase in the number of clients. In addition, more than 4 million guests have used the online check-in solution provided by thousands of hotels.

‘This capital increase will enable us to lead the shift towards the 100% online digitization of the online check-in process in hotels and hotel chains. At Civitfun Hospitality, we want to strengthen our leadership in Spain and replicate the same process in Europe and Latin America, where we are also currently operating. Civitfun Hub will help us grow by engaging all key industry players in the digitization of online check-ins,’ says Civitfun Hospitality CEO Mariano de Oleza.

About Civitfun Hospitality

Civitfun Hospitality was founded by Mariano de Oleza, Germán March, Javier Gómez, and Massimo de Faveri seven years ago. Since then, the company has helped hotels and hotel chains automate millions of online guest check-ins all around the world, operating in more than 20 countries and providing their online check-in solution to over 250,000 rooms. The leading online check-in solution for hotels and hotel chains in Spain launched Civitfun Hub to provide any OTA, Tour Operator, or any travel company with the option to offer an online check-in process integrated with the main PMS in the industry. In addition, it successfully partnered with Booking.com to digitize online check-ins at hotels and hotel chains.

The startup participated in the 2017 Seedrocket campus, won in the startup category of the Business Travel IBTA 2016 award, was chosen as a finalist in the travel category of South Summit 2021, among other milestones, and is now part of the investment portfolio of P101 SGR.

- The digital company already leads the industry in Europe and in just two years has experienced a 15-fold increase in its turnover: from €1M in 2019 to profits of €15M in 2021

- This capital injection, led by the international investment fund P101, and co-led by Autotech Ventures and Maniv Mobility, will allow the company to hire 50 engineers to implement technological improvements on the platform and grow internationally

Barcelona, February 9 2022. Mundimoto, the largest online motorcycle buying and selling platform in Europe, manages to raise 20 million euros in an investment round led by the international fund P101, and co-led by Autotech Ventures and Maniv Mobility. This capital increase represents a decisive injection for the company, which plans to hire 50 engineers and 250 new employees and start its international growth plan throughout Europe.

The round is led by P101, one of the leading venture capital firms in Italy, with assets under management of more than 200 million euros, and which has already invested in Spanish startups such as DeporVillage, Colvin and Bipi. “The outstanding performance of the last 24 months is in our opinion just the tip of the iceberg of what Mundimoto’s stellar team can achieve in the motorbike sector, which has been left behind in the digital transformation that have touched consumer sectors across the board. We are convinced Mundimoto have all the ingredients to build a very strong, pan-European player that will transform the two-wheel industry through innovative ownership models and a more sustainable and circular value chain, starting from the great opportunity in the Spanish and Italian markets” – Stefano Guidotti, Partner at P101. On the other hand, the round is completed by Autotech Ventures and Maniv Mobility participations, the largest mobility specialised funds in the United States and Israel, respectively.

The digital company, which was founded in Barcelona in 2019 by two friends, Alberto Fossas, a businessman and motoring expert, and Josep Talavera, an entrepreneur with a wide previous experience on creating several digital companies, such as Decowood, began its journey with an initial investment of €500,000 – €250,000 by each of the co-founders- and today it already leads the sector in Europe.

Since its creation, Mundimoto has seen a 15-fold increase in turnover: from €1 million in 2019 to earnings of €15 million in 2021.

Josep Talavera, co-founder and Mundimoto’s CEO, explains that: “This capital increase is a unique opportunity to improve and adapt the platform’s services for the growing demand, as well as to make the leap to Italy, the country with the highest volume of motorcycles in Europe, and to the Netherlands. 15% of our sales are already international and it is crucial for the company to be able to invest more resources in our expansion operations and hiring qualified staff to make it possible.”

Mundimoto is a 100% online, fast and safe service to buy and sell motorcycles through its website: Mundimoto.com. So, the company offers sales facilities as online valuation, secure and direct payment to the user’s account, vehicle pick-up at home and free change of ownership, as well as purchase facilities.

Being an online platform allows important cost savings that result in more competitive prices compared to other companies in the sector. In addition, Mundimoto has an avant-garde workshop team to manage the previous reconditioning of the vehicles. Also, the company allows flexibility in financing and has a delivery service to receive the vehicle directly at home. The company acquires an average of 1000 motorcycles per month and, in the last year, Mundimoto has sold a total of 4000 vehicles.

15% of Mundimoto’s sales are already international

15% of Mundimoto’s sales are already international and come from Poland and Holland. Nationally, 30% of sales come from Catalonia and 70% from the rest of Spain.

This financing round will allow for two new openings in Europe: in Italy and Holland, as well as further growth in Spain. Also, Mundimoto plans to start its international growth plan throughout Europe soon.

The company has recently moved into Panrico’s former logistics centre in La Verneda, outside Barcelona, with more than 17,000m2, where the headquarters and the logistics centre are located.

A project backed by successful entrepreneurs

With the goal of growing Mundimoto in Europe, Albert Fossas and Josep Talavera have surrounded themselves, from the beginning, with a team of expert entrepreneurs such as Alex Lopera, co-founder of VERSE and TipsterChat, as director of operations, and Pablo Fernández, co-founder of Clicars, as investor and advisor, among others.

In addition, Mundimoto has recently incorporated three new figures to carry out the expansion platform’s next steps: Jordi Pellat, as VP of Engineering, Jacob Cañadas, as new CTO (Chief Technology Officer) and Jaume Civit as Chief Data Officer. All three have wide experience in globally successful digital companies such as Facebook, Snapchat, Typeform and Wallapop.

About Mundimoto

Mundimoto is the Spanish online motorcycle buying and selling start-up that offers a 100% online, fast and safe service. Created in 2019 by two friends, Alberto Fossas, and Josep Talavera, Mundimoto has become the largest online motorcycle buying and selling platform in Europe. The company acquires an average of 1000 motorcycles per month and in 2021 has sold 4000 vehicles. Located in Barcelona, it has 150 employees in Spain. Mundimoto plans to open an office in Milan, Italy, and in the coming months also in Holland and to continue its consolidation in Spain.

About P101 SGR

P101 SGR is one of the leading venture capital firms in Italy, investing in digital and technology-driven companies in Europe. Founded in 2013 by Andrea Di Camillo, it is supported by Azimut, Fondo Italiano di Investimento, European Investment Fund, Fondo Pensione BCC, Cassa Forense, as well as some of the main Italian entrepreneurial families.

P101 SGR currently manages two funds, as well as the first VC retail investment fund, developed in collaboration with Azimut Group. Managing assets for over € 200 million, P101 has invested in over 40 tech companies, including Opyn, Cortilia, Milkman, MusixMatch and Tannico.

For more information:

Rocio Carasso

627368842

- Il round da 15 milioni di dollari è stato guidato da P101 SGR attraverso il suo secondo veicolo d’investimento P102 e ITALIA 500 (Gruppo Azimut) e dalla società di investimento svizzera HBM Healthcare Investments. Giuseppe Donvito, Partner di P101 e Alexander Asam, Investment Advisor di HBM Partners entreranno a far parte del board di 1000Farmacie.

- 1000Farmacie opera nel settore e-pharmacy, riunendo su un’unica piattaforma online le migliori farmacie italiane, per consentire ai clienti di trovare sempre il prodotto cercato, al prezzo migliore e con consegna a domicilio. Fondata nel 2020, nell’ultimo anno ha visto una crescita del 600%.

- Il funding servirà per espandere l’attività e il servizio di consegna dell’ultimo miglio. Entro il 2023 inoltre la società integrerà anche servizi aggiuntivi di assistenza sanitaria per supportare i pazienti.

Milano, 8 febbraio 2022 – 1000Farmacie, il marketplace che unisce le migliori farmacie italiane su un’unica piattaforma online garantendo ai consumatori ampia scelta, consegna veloce e convenienza, chiude un round di investimento da $15 milioni, guidato da P101 SGR – attraverso il suo secondo veicolo P102 e ITALIA 500 (fondo di venture capital istituito da Azimut Libera Impresa sgr e gestito in delega da P101) – e da HBM Healthcare Investments, uno dei principali investitori mondiali nell’innovazione sanitaria, quotato alla Borsa svizzera.

Al round hanno partecipato anche il family office svizzero Corisol Holding, Club degli Investitori (che ha effettuato l’investimento per il tramite della Simon Fiduciaria del gruppo Ersel), IAG, LIFTT e Healthware Ventures (che aveva già investito nella startup in fase seed). La startup ad aprile 2020 aveva già chiuso un round seed da $ 1,7 milioni, portando così il totale raccolto a circa 17 milioni di dollari.

Con i fondi raccolti la società punta a espandere l’attività e il suo servizio di consegna dell’ultimo miglio (sul modello di Pillpack, startup americana acquisita da Amazon nel 2018) e a rendere maggiormente capillare la propria rete di partnership con le farmacie locali. Entro il 2023 inoltre 1000Farmacie intende integrare all’interno della piattaforma servizi aggiuntivi di assistenza sanitaria per supportare maggiormente i pazienti.

Il mercato farmaceutico italiano è molto frammentato e attualmente è determinato da circa 23.000 farmacie indipendenti, che non utilizzano canali di vendita online e dispongono di uno stock limitato: la tecnologia di 1000Farmacie integra su un’unica piattaforma i magazzini delle farmacie indipendenti più performanti, per crearne uno comune in modo da offrire all’utente il maggior assortimento possibile e un servizio di delivery più veloce ed efficiente. Assistenza centrata sui clienti e attenzione al loro benessere sono fondamentali per la piattaforma, che seleziona con cura ogni farmacia per assicurarsi che questi valori vengano trasmessi all’utente in ogni momento.

Fondata a marzo 2020 dal CEO Nicolò Petrone – che in precedenza ha finalizzato un’operazione di exit con la piattaforma fintech MEDICI, acquisita dall’unicorno Prove – e dai due co-founders Mohamed Younes (COO) ed Alberto Marchetti (CMO), la società ha visto in meno di due anni una crescita esponenziale. Con una rete di oltre 100 farmacie indipendenti nelle maggiori città italiane e 95.000 prodotti in vendita, 1000Farmacie conta oggi più di 250.000 clienti e una crescita del fatturato del 600% nell’ultimo anno. La startup inoltre collabora con alcune importanti big Pharma che possono servirsi della tecnologia sviluppata da 1000Farmacie per rendere più efficiente il proprio servizio di delivery di farmaci.

1000Farmacie si inserisce nel settore e-pharmacy, mercato con un valore potenziale di 180 miliardi di euro in Europa ma con una penetrazione online ancora prossima allo zero (fonte Sempora). Si tratta infatti di un mercato altamente frammentato, ancora fortemente legato alla

vendita off-line (oltre 200.000 prodotti venduti in più di 50.000 negozi fisici in Europa) e con una presenza piuttosto bassa di marketplace digitali, che al momento coprono soltanto il 25-30% del mercato. In Italia in particolare le potenzialità di sviluppo sono enormi: nel nostro Paese, infatti, il tasso di penetrazione del settore e-pharmacy è tra i più bassi in Europa (4,5%) ed è inferiore anche a quello di altri settori come viaggi (34%) ed elettronica (24%), ma sta crescendo molto più rapidamente: tra il 2018 e il 2020 ha infatti triplicato il suo volume.

“La nostra missione è rendere i nostri clienti soddisfatti migliorando la loro esperienza di acquisto: grazie a questo round potremo ampliare notevolmente la gamma di servizi offerti, innovando un settore che è ancora fortemente arretrato da un punto di vista digitale. In Italia il prezzo dello stesso medicinale varia moltissimo da farmacia a farmacia. La nostra piattaforma rende visibili queste differenze, in modo da aiutare il cliente a trovare sempre tutti i prodotti che sta cercando al miglior prezzo sul mercato”, afferma Nicolò Petrone, CEO di 1000Farmacie.

“Le potenzialità e gli elevati tassi di crescita sottostanti il settore dell’e-pharmacy ci hanno spinto senza esitazione ad investire su 1000Farmacie. Siamo certi che, anche grazie all’elevata capacità del team manageriale, in poco tempo la società ricoprirà una posizione da leader e siamo orgogliosi di aver contribuito fin da subito alla sua crescita. Amiamo i progetti in grado di svecchiare il loro settore di riferimento portando una ventata tecnologica ed innovativa: e 1000Farmacie è sicuramente uno di questi”, afferma Giuseppe Donvito, Partner di P101 SGR.

“Siamo lieti di portare in 1000Farmacie il nostro expertise maturato a livello globale nel segmento dell’e-pharmacy. HBM ha infatti investito early stage anche nel marketplace farmaceutico indiano Tata 1mg, nell’azienda leader nel settore sanitario digitale latinoamericano Farmalisto e in Jianke (la principale azienda cinese di assistenza sanitaria digitale e telemedicina). Inoltre, HBM è anche uno dei primi investitori nella community digitale di infermieri e assistenti sanitari ConnectRN, con sede negli Stati Uniti”, conclude Matthias Fehr, Board Member, Head of Private Equity di HBM Partners, Svizzera

P101 SGR

P101 SGR è uno dei principali gestori di fondi di venture capital in Italia, specializzato in investimenti in società̀ innovative e technology driven in Europa. Nato nel 2013 e fondato da Andrea Di Camillo, annovera tra gli investitori dei propri fondi Azimut, Fondo Italiano di Investimento, European Investment Fund, Fondo Pensione BCC, Cassa Forense oltre ad alcune tra le principali famiglie imprenditoriali italiane. P101 SGR, gestisce attualmente due fondi, oltre al primo veicolo di investimento retail destinato al venture capital sviluppato in collaborazione con il Gruppo Azimut. Con masse in gestione superiori a € 200 milioni, P101 ha investito in oltre 40 società tra cui Opyn (ex BorsadelCredito.it), Cortilia, Milkman, MusixMatch, e Tannico.

HBM HEALTHCARE INVESTMENTS

HBM Healthcare Investments investe nel settore sanitario. La Società detiene e gestisce un portafoglio internazionale di aziende promettenti nei settori della medicina umana, delle biotecnologie, della tecnologia medica, della diagnostica e della sanità digitale. I prodotti di punta di molte di queste aziende sono già disponibili sul mercato o in una fase avanzata di sviluppo. Le società in portafoglio sono seguite da vicino e guidate attivamente nella loro direzione strategica. Questo è ciò che rende HBM Healthcare Investments un’interessante alternativa agli investimenti in grandi aziende farmaceutiche e biotecnologiche. HBM Healthcare Investments ha una base di azionisti internazionali ed è quotata su SIX Swiss Exchange (ticker: HBMN).

Ufficio Stampa P101 SGR

ddl studio – p101@ddlstudio.net

Irene Longhin – 392 78116778

Sabrina Barozzi – 333 6158644

Biometric authentication innovator eliminates password-based account takeover and enables PSD2 Strong Customer Authentication while preserving user privacy

SAN FRANCISCO, Nov. 17, 2021 (GLOBE NEWSWIRE) — Sift, the leader in Digital Trust & Safety, today announced that it has acquired Keyless, a pioneer in passwordless and multi-factor authentication. Keyless’ zero-knowledge cryptography and privacy-preserving biometric authentication technology eliminates account takeover (ATO) fraud due to weak or stolen passwords, phishing, and credential reuse, while allowing users to log into websites and apps simply by looking into their device’s camera. Keyless’ technology meets the Strong Authentication Compliance requirements of PSD2, is FIDO Certified, and helps online businesses more easily meet the requirements of GDPR. Sift will offer Keyless products to regulated businesses and online merchants around the world.

With account takeover attacks reaching new and sustained heights during the COVID-19 pandemic, businesses have faced an ongoing, evolving threat from cybercriminals using large-scale automation to launch massive ATO attacks to steal stored account value, payment information, and other personal data. Keyless’ biometric-based authentication eliminates a primary vector of ATO attacks by solving the root problem: passwords. Adding to the ATO prevention capabilities in Sift Account Defense, Keyless provides account security for any business that is ready to embrace a passwordless customer experience through multi-factor authentication that seamlessly allows users to log in to sites and apps from any device.

Keyless’ proprietary technology frees businesses from storing and managing passwords. Rather than tying a user’s biometric factor to a password, Keyless’ SDKs allow businesses to deploy biometric logins interoperably on their websites and apps as the primary authentication mechanism, or integrate the Keyless authenticator app into the login experience. In either deployment, users can simply look into the camera on their smartphone or computer to authenticate, with a consistent experience across devices.

“Protecting businesses from fraud while reducing customer friction is the foundation of a Digital Trust & Safety strategy,” said Marc Olesen, President & CEO of Sift. “Keyless has created a truly innovative product that provides better account security with less friction for users, and meets the qualifications for regional regulations like PSD2. We’re so excited to bring the Keyless team to Sift and for our customers to benefit from their incredible technology and expertise.”

Importantly, Keyless puts privacy at the center of the experience by authenticating users without storing their biometric or cryptographic information on their device or in any central location—and by leveraging advanced privacy-preserving, multi-party computation protocols. The Keyless network does not have access to the biometrics, and therefore no one but the user has access to it.

“Our mission at Keyless is to provide people and organizations with a passwordless future, where the user is the key,” said Andrea Carmignani, CEO and Co-founder of Keyless. “Joining Sift will allow us to reach businesses around the world, stop account takeover attacks at scale, and ensure that users can authenticate seamlessly across devices with nothing more than a glance at their device’s camera.”

“Advances in biometric technology have signaled the beginning of the end for passwords,” said Andrew Shikiar, Executive Director and CMO of the FIDO Alliance, an open industry association focused on providing open and free authentication standards. “Keyless has developed a novel and secure approach that leverages FIDO’s protocols to make authentication easier for consumers. I look forward to seeing Sift and Keyless drive adoption of this standards-based technology that both businesses and consumers desperately need to thwart the growing number of account takeover attacks.”

For more information on Sift’s acquisition of Keyless, go here.

About Sift

Sift is the leader in Digital Trust & Safety, empowering digital disruptors to Fortune 500 companies to unlock new revenue without risk. Sift dynamically prevents fraud and abuse through industry-leading technology and expertise, an unrivaled global data network of 70 billion events per month, and a commitment to long-term customer partnerships. Global brands such as Airbnb, Doordash, and Wayfair rely on Sift to gain a competitive advantage in their markets. Visit us at sift.com, and follow us on Twitter @GetSift.

Media Contact:

Victor White

Senior Director of Corporate Communications, Sift

press@sift.com

Around the corner there will be many open challenges and surprises, in the post-Covid time that still needs to be imagined. According to McKinsey & Company, in 2020 European economies shrank by 11% on average, and the most updated estimates show that there will be no return to pre-Covid levels until 2023. In this context, traditional finance has been forced to a sudden change of perspective. It was widely known that digitization would be its near future, since the demand for smarter services by Millennials and Gen Z (the new bank customers) had been growing for years. However, as everyone has already noticed, social distancing has hastened this secular change. More and more traditional banks are interacting deeply with Fintech companies, and fintech companies are turning into new entities. The first movers of this evolution are, on the one hand, colossal challenger banks and, on the other, innovative traditional banks. They have a clear advantage.

In the near future, two main aspects will influence the scenarios of an increasingly intense collaboration between banks and fintech companies. First of all, Fintech companies are growing from small to medium size – and in this process they will have to abandon the start-up fail-fast method. At the same time, traditional banks will need to abandon legacy technologies to become more agile. Each side is going more and more towards the other, until they will merge. The bank that awaits us will be increasingly technological and digital. Concepts such as open banking, digital lending, API (Application Programming Interface) and PaaS (Platform as a Service) are and will be particularly interesting.

Digital native services and regulation are the advantages of Fintech

Meanwhile, 2020 has been a good year for financial technology overall. It’s true that the general slowdown of economy has had an inevitable impact on investments, which have been penalized by uncertainty and the rescheduling of all business plans. But despite all this, Fintech companies have capitalized on their advantage: i.e., offering digital native services and modifying their offer to meet the fluctuating needs of the market. This advantage was particularly strong in 2020, when customers had to access and manage their finances remotely, which is not always so easy to do with traditional financial institutions. Furthermore, the European regulation of crowdfunding is on its way: it puts lending and equity side by side and paves the way for new opportunities.

Public assistance and Brexit

LendIt asked some questions to Fintech operators that are based mainly in the United Kingdom (33%), Poland (13%), Italy (11%), and Germany (7%). It emerged that the most disruptive thing in 2020 was government intervention. First of all, there were anti-Covid aid plans, which have had a positive impact, since Fintech companies were able to lend state-guaranteed loans to the real economy. Fintech lending proved to be effective, as opposed to the bureaucratic delays of most banks, whose loans to SMEs too often arrived late. Furthermore, anti-Covid economic measures have been important for some Fintech companies, as they have spurred a skyrocketing increase in corporate lending. Others, however, found that, overall, these measures have been insufficient.

A further element of change is Brexit, which altered Europe’s financial equilibrium, shuffling the cards on the European Fintech table. It has probably created strong demand for data hosting and management solutions on both sides of the Channel, but it has also significantly complicated cross-border trade, not to mention that it presents regulatory challenges that have yet to be assessed.

Which Fintech companies are leading the innovation?

As for the companies that stood out in 2020, the Fintech ecosystem agrees that the podium goes to Revolut, the fastest growing challenger bank in Europe, which has received most financing at a higher valuation. But what is stunning is the pace at which it launches new products, both in the UK market and internationally.

In second place, Fintech companies suggest Starling Bank, another challenger bank that might reach the unicorn status thanks to its latest financing round. It is the only neobank that was started by an experienced former banker, and it would seem that its particularly careful management approach is paying off, since at the end of 2020 it had already reached its break-even point.

Finally, Klarna, the Swedish buy-now-pay-later giant, stands out among the Fintech leaders, as it is on the verge of another monster round that will bring its value between £25 and £30 billion. Its business in the United States adds one million new customers a month to the 90 million they already have around the world.

And which banks?

Some “traditional” banks have also embraced innovation. According to Fintech companies, the most innovative one is BBVA, that has been the leader of digital transformation in the last ten years. It launched its innovation hub in 2010, to interact with the Fintech ecosystem more easily, and was one of the first banks to invest in Fintech companies with its venture capital fund, Propel Venture Partners. Mastercard, too, is considered to be an innovator. In 2020, it launched Mastercard Fintech Express in Europe, to help Fintech start-ups leverage the Group’s extensive network of partnerships. Last but not least, when Goldman Sachs launched its Marcus brand in the summer of 2018, many wondered if it would be successful. Since then, aggressive savings rates have led 500,000 customers to deposit £21 billion. What is most impressive, however, is that it is reinventing itself from solid investment bank to innovative digital bank offering cutting-edge products.

Therefore, overall, the outlook is optimistic. Fintech companies keep growing geographically, they are developing new products and services, although they find that raising capital is becoming increasingly difficult. We believe that this obstacle will soon be overcome by the general need – of banks too – to accelerate the process of digitization. A this will very soon change the world of finance for good.

“Some say the Chinese have all the data and the Americans have all the money. But when I see what we have going for us here in Europe, I see that we have purpose”. European Commissioner for Competition Margrethe Vestager pronounced these words during a hearing on European people’s disaffection for technology. They date back to October 2019, before the pandemic, and today they sound like an omen. In particular, Vestager was referring to Artificial Intelligence: the European one “is in health, in environment, in transportation organization. It is where you want to see AI being used for a greater purpose: and that I find is a good inspiration to figure out how to make data available and how to find the funds so that we can invest”.

To have a goal, a reason beyond profit, a purpose, is what can distinguish start-up companies from late-coming Europe from Asian and American giants. And somehow compensate our weak growth.

Why do we need more purpose?

Actually, it’s something we have always identified with. To focus on improving the world’s climate, fighting global warming, solving the problem of educational poverty, increasing women’s employment conditions, contributing to the development of microbusinesses and neighbourhood businesses: in one word, to retrieve humanistic capitalism from Olivetti’s time. This has been our direction over the last five years and this idea must keep guiding us, since it can help Europe and Italy attracting talents, consumers, investors. More and more, today, talents follow purpose, rather than profit, and so does a great part of the market.

Goal-driven investing: it’s all about DNA

Purpose-driven tech belongs to P101’s DNA, as proved by its track record of investments, all based on a common goal: to make entire sectors or production chains more efficient through technology, with great attention to sustainability and social impact. This is what guides us through every due diligence, together with a company’s business plan and market perspective. We fund and support the development of the people leading the start-up companies we invest in. A start-up company is successful when it manages to change the world for the better.

20B in five years: the journey of purpose-driven tech has just begun

According to the data in “The state of European Tech” reports by Atomico from 2020 and 2019, 2019 had closed with record numbers for tech start-up investments in Europe, reaching a value of € 38.6 billion, 16 billion of which came from European VC funds. That was the peak of a 5-year-long path of exponential growth that contributed to a general trust boost in European start-ups and technology. 180 unicorns were born. Covid-19 has almost tore down all that we had created, though in the end, not only has the house held up, but it has also become potentially indestructible. In just 8 weeks, tech start-ups have enabled a digital transformation that would have otherwise taken 10 years to happen and managed to collect € 41 billion, more than they did in 2019.

17% of this amount went to purpose-driven tech companies, accounting for a 6 billion share. 80% was allocated to start-ups where purpose is not an incidental factor, rather, it’s at the core of their business model.

Actually, the growth in purpose-driven tech has walked hand in hand with the general growth in start-up investments: over the last five years € 20 billion have been invested across more than 3,000 rounds into companies with this kind of structure.

USA vs Europe: old against new?

Atomico also shows how important the moral issue is in the Old Continent. If we analyse Internet threads, we’ll find out that in the United States the techlash narrative is driven by the Big Tech companies, by their business failures and slowdowns. On the contrary, Europe focusses on data privacy, antitrust, tech ethics and the gig economy.

While, on the one hand, this reveals how consumers think, on the other, it is important to point out that 80% of VC funds investing in Europe also stated that they take into consideration the potential long-term societal and/or environmental impact of an investment, both as part of a due diligence process (47%) and during the investment life cycle.

Nearly two-thirds of VC companies agree that in the last 12 months a greater concern about the potential societal or environmental impact of their portfolios is manifest.

It comes as no surprise, then, that one in five start-uppers states that to them to measure the societal and/or environmental impact of their company is a priority.

Digital and social acceleration brought on by the pandemic

The pandemic has accelerated the digitalisation of ecosystems and it has speeded up the race towards sustainability that was already happening among start-up companies in 2019. Dealroom estimated that the European VC-backed tech companies addressing one or more United Nations Sustainable Development Goals are 528. The fight against global warming has attracted the greatest investments into purpose-driven tech (11 billion since 2016), followed by renewable energy, which has attracted $9.7 billion since 2016.

Even if purpose-driven deals are steadily increasing, in 2019 they represented less than 5% of all deal activity. The UK, France and Germany were leading the rank of countries investing in a more sustainable way, while Italy was ranked number nine. This means that our margin for growth is still huge, and we believe that from the union of, on one side, the thrive towards societal and environmental sustainability, and on the other side, the continuous development of innovation, we are going to build Europe’s and Italy’s future competitive advantage.

In recent years, very few industries have grown as much as that of food delivery. As stated in the B2C eCommerce Observatory by Politecnico di Milano University and Netcomm, in 2020 Food&Grocery e-commerce grew at a rate of +70% YoY (while in 2019 the growth rate had been +56%).

For Mymenu, in addition to being a year of important growth, 2020 was also a landmark that led the company to the important results that showed in 2021: its acquisition by Pellegrini Group, an Italian reference brand in the market of corporate catering services, food supply, meal vouchers and corporate welfare.

Team up and stand up to the big players

One wonders how an Italian start-up company, which has to measure against international players every day, has succeeded in this important undertaking. The answer, as usual, is: thanks to their team and their ability to join forces at all times. Not to become the greatest, rather, to do well, pursuing their goals, without losing their nature along the way, improving every day.

Mymenu was born from the merger of a Paduan start-up company and Sgnam, from Bologna (which also acquired the Milanese Bacchetteforchette). It is the largest Italian company in the food delivery industry because it has been able to find its own, unique, identity. It focusses on a medium-high consumer range, through a selection of restaurants targeting senior customers and B2B service. Thus, if in 2019 the average receipt of this industry was 15-20 euros (and was delivered by big players such as Deliveroo, Just Eat, Glovo – which center their business on the high number of deliveries), that of Mymenu was 38 euros (grown by 20% in 2020). This means they have higher margins on orders and therefore a higher sustainability, which, among other things, allowed Mymenu to reach breakeven last year.

The role of Venture Capital

The vision of the founders joined the experience of P101 in 2014. P101 helped the young team pursue its goals, create a network, but not just that. The support of a Venture Capital fund, according to Giovanni Cavallo, co-founder of one of the three companies that merged into Mymenu, has also helped him broaden his vision as an entrepreneur and walk in the investor’s shoes.

“We have learnt to be punctual on data analysis and reporting. Having to send a monthly report to investors has taught us the importance of discipline and of making decisions that are mainly based on data. At the same time, trying walking in the investor’s shoes has allowed us to fully understand market opportunities.”

Because the needs of entrepreneurs and those of investors are different, but their goals are the same. “P101 has pointed us towards bigger markets, with a high potential for growth” stated Giovanni Cavallo. “Mymenu was our first great training ground. We’ll keep on training every day.”

The role of Venture Capital is also that of giving advice, to help create a sustainable strategy, and much more. In the acquisition by Pellegrini, P101 immediately advised Mymenu to be assisted by a financial advisor.

Everyone has their job, but when skills come together, the whole team wins. Mymenu founders have shown tenaciousness and listening skills, and this is what our VC fund has focused on, helping them on their path of growth and in the evolution of their business model.

The goal of a VC fund is not always that of creating a unicorn: the truly important thing is to create a healthy and sustainable company.