Embracing the VC Data-Driven Transformation

Introduction

In an era where technology dictates the pace and direction of markets, the venture capital (VC) industry is entering a transformative phase marked by a data-driven revolution.

Despite their pioneering role in the digital age, VC firms have only recently begun to integrate advanced data practices into their decision-making processes and workflows. To drive this shift, VCs are establishing dedicated data divisions and hiring engineers, developers, data scientists, and product managers.

This strategic pivot aims to enhance competitiveness, operational efficiency, and investment effectiveness in an increasingly complex market. It mirrors the revolution in algorithmic trading that transformed public markets in the 1980s.

Looking ahead, we foresee a landscape where VC thought leaders will have a high rate of engineering talent at both operational and management levels. As of 2023, only 1% of VC firms globally had internal data-driven initiatives*, with a small fraction at the forefront. At P101, we spearheaded this shift in Italy by establishing the Data Insight division in 2022, aiming to drive data-driven initiatives, and we have been recognized among the leading 190 data-driven venture firms worldwide*.

*Source: Data-driven VC Landscape 2023 – Data-driven VC Landscape 2024

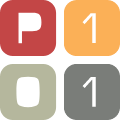

Why Now

The data-driven revolution in venture capital is accelerating due to two pivotal factors:

- Data Availability: Venture capitalists now have unprecedented access to varied data types at the startup stage, including financial metrics, consumer behavior analytics, market penetration, and competitive landscape insights.

- Technological Advancements: Venture capitalists now have access to off-the-shelf VC-focused tools, as well as analytics and AI technologies, capable of analyzing both structured and unstructured data, even with limited data points.

A decade ago, the venture capital sector lacked accessible, reliable data, with un-digitized public registers and nascent platforms like Crunchbase and LinkedIn offering limited information. Now, venture capitalists access abundant public data, utilize specialized data services, and develop proprietary datasets to stay competitive.

This surge in data availability coincides with advances in analytics and AI technologies, including machine learning models, large language models (LLMs), and natural language processing (NLP) technologies. These advancements have automated data analysis and generated insights from unstructured data sources, enhancing the depth and accuracy of investment evaluations.

The emergence of “Investment Tech” tools is further driving the current data-driven transition. While established in public markets, these tools are now evolving for private markets. Investment tech comprises specialized software and platforms that enhance deal sourcing, due diligence, portfolio management, and reporting to optimize investment processes and decision-making. These tools democratize advanced investment capabilities, making them accessible to more venture capitalists and enhancing the reach of data-driven investing.

This transformation allows venture capital to move from reliance on intuition and personal networks to an evidence-based approach similar to methods used in more mature asset classes. Armed with comprehensive data and powerful analytical tools, venture capitalists can now cover the market more comprehensively, track startup progress more effectively, and make strategic investment decisions with increased speed and accuracy.

Source: P101 Data Insight

What is a Data-Driven VC

A data-driven venture capital fund leverages data analytics and technology to enhance its investment decisions and operations.

Historically, venture capital has relied heavily on gut instincts and personal networks. However, the digital age demands a more sophisticated approach. VC firms are now creating dedicated data divisions – hiring engineers, developers, data scientists and product managers – to harness the power of data, focusing on three key areas:

- Efficiency: By structuring and digitizing operations, VCs can scale while maintaining consistent performance, manage larger portfolios with fewer resources, reduce operational costs, and improve marginality and responsiveness.

- Effectiveness: Expanding VC’s coverage and reach enhances the ability to anticipate industry trends and refine investment accuracy. This reduces biases and inequalities in capital allocation and decreases the likelihood of missing opportunities or backing underperformers.

- Competitiveness: Leveraging data-driven strategies serves as a key differentiator, appealing to both innovative startups and investors. VCs can offer new and improved services to LPs and portfolio companies, such as advanced data portals, performance benchmarking, and interactive fund reporting.

Balancing data-driven insights with traditional, qualitative methods is essential in venture capital. Human judgment, such as assessing leadership qualities and understanding market dynamics, remains indispensable. While data can identify trends and opportunities, the nuances of strategic decisions depend on human expertise. Thus, the most effective VC strategies combine analytics with the critical insights that only people can provide.

The Recipe of a Data-Driven VC

Contrary to the common misconception, becoming data-driven in venture capital isn’t solely about deploying advanced AI algorithms, Machine Learning models, or purchasing cutting-edge technology. The journey to becoming data-driven starts with fundamental, yet crucial steps that lay the groundwork for building a comprehensive data-driven infrastructure.

While newer VC firms benefit from greenfield situations, established ones encounter greater challenges due to the need for migrating existing systems, changing processes and overcoming cultural resistance.

The recipe for a successful transformation into a data-driven VC involves several critical ingredients:

- Strategic Hiring: The foundation of a data-driven VC firm is its people. Recruiting talented engineers, data scientists, software developers and product managers who collaborate closely with investment and fund administration teams is crucial. These professionals drive the firm’s transformation by integrating new technologies and data insights into everyday processes.

- Process Engineering: Transitioning to data-driven operations requires a thorough overhaul of existing processes. This involves mapping and analyzing current workflows to identify pain points, bottlenecks, and areas ripe for improvement and automation. By redesigning these processes, firms can maximize technology use, streamline operations, and enhance efficiency.

- Technology Investment: A balanced approach to technology—incorporating both advanced off-the-shelf software and custom-developed tools—is essential. These technologies should address specific needs in domains such as databases, process automation, data analytics, business intelligence, CRMs, portfolio management tools. Investing in the right technology stack enables firms to handle complex data and derive actionable insights effectively.

- Cultural Shift: Adopting a data-driven model necessitates a shift in corporate culture. This shift involves promoting data literacy across all organizational levels and valuing data-driven insights as much as traditional investment acumen. A culture that embraces innovation and informed decision-making not only supports data initiatives but also propels the firm ahead of its competitors.

This strategic blend of people, processes, technology, and culture forms the essential blueprint for any VC firm aiming to thrive in today’s data-intensive environment.

The Path to Becoming a Data-Driven VC

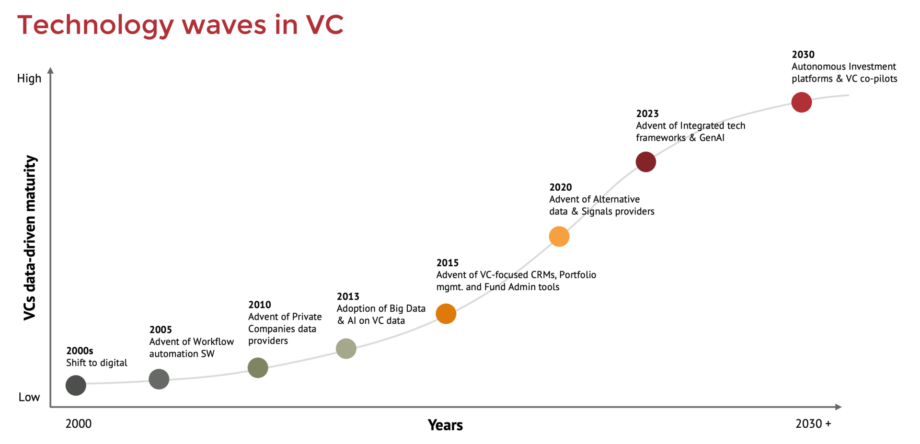

Venture capital firms evolve gradually through various stages of data utilization and sophistication, changing the paradigm of the required skills and tool sets. Data and engineering roles are now on top of the VC hiring agenda to drive the move towards the Data-Driven stage. This iterative journey enhances their capabilities in data handling and decision-making processes. Currently most VCs sit within the Traditional and Productivity stages. Here are the three stages of maturity in becoming a data-driven VC*:

- Traditional VCs: These firms rely heavily on manual workflows, with minimal collaboration. Their technological stack includes basic tools like legacy CRMs, email, Slack or WhatsApp for communication, and Excel for database management along with the standard MS Office or GSuite.

- Data Team: Non-existent, as there is no dedicated personnel for data management or analysis.

- Productivity VCs: At this stage, firms focus on automating and industrializing processes. They adopt specialized, off-the-shelf tools tailored for VCs, such as CRMs (Affinity, Attio), portfolio management software (Rundit, Vestberry), valuation tools (Valutico), and project management and knowledge sharing platforms (Notion). Additionally, they integrate automated workflow tools (Zapier), GenAI agents (OpenAI, Gemini, Claude, Perplexity), and efficient scheduling software (Calendly).

- Data Team: Consists of individuals with a technical background, though not necessarily engineers, as extensive coding skills are not required.

- Data-Driven VCs: These firms are highly sophisticated, focusing on developing their own custom and scalable solutions. They use advanced programming and DevOps tools (Python, Java, GitHub, Airflow), tap into alternative data sources (Specter, Synaptic), and leverage robust cloud infrastructure and computing platforms (AWS, GCP, Azure). They also manage custom databases (PostgreSQL, MySQL, MongoDB) and utilize sophisticated workflow management platforms (Airflow) and custom front-ends and business intelligence tools.

- Data Team: Comprises highly technical roles, including data engineers, software developers, and data scientists, all integral to the firm’s data strategy.

Each stage marks a significant progression in a VC firm’s journey towards fully integrating data-driven methodologies, each more advanced and integrated than the last.

*Source: Data-driven VC Landscape 2023 – image replicated

The Make or Buy dilemma

In the realm of data-driven venture capital, the strategic “Make or Buy?” decision – whether to build in-house solutions or purchase off-the-shelf products – is crucial and often hinges on the capital availability and budget of the VC firm.

The fund’s size is pivotal, as management fees from the fund size directly affect the budget for these initiatives. Smaller funds, typically under €100 million, tend to purchase off-the-shelf solutions due to budget constraints. They gradually build basic bespoke tools as resources allow, such as basic process automation, custom databases, and data pipelines.

In contrast, larger firms with more capital can invest in developing advanced custom tools tailored to their needs, like proprietary deal sourcing platforms, advanced screening models, due diligence tools, and portfolio monitoring software.

Investment Technology plays a vital role in this transition, offering off-the-shelf solutions that enable VCs to adopt data-driven practices without building proprietary technologies from scratch. Hence, the buy option is increasingly more valid since there are increasingly more tools that perform tasks that previously were achievable only through custom solutions.

Though, investment tech tools are poised to become commoditized and VCs will need to differentiate in two ways:

- Implementation and Exploitation: The way tools are implemented and integrated into workflows and operations. Similar to how everyone can buy Coca-Cola ingredients, but the unique processing creates the secret recipe.

- Custom Tools: Developing tools that reflect the specific methodologies and cultural nuances of a firm. Unique application and integration of these tools provide a competitive edge in the industry.

The most effective strategy often turns out to be a hybrid approach, balancing off-the-shelf products with custom development based on the firm’s strategy and capital availability. This tailored approach allows VCs to leverage the strengths of both options, optimizing their technological investments to suit their specific needs and financial capacity.

Automating the VC Investment process

A key question in venture capital today is whether the investment process can become fully automated, akin to the algorithmic trading that currently dominates over 70% of the public equity market.

The short answer is: it could happen, but not in the near future. VC investments are intrinsically tied to qualitative valuations and human interactions. Understanding a team’s dynamics, the startup’s culture, evaluating the timing and execution capabilities, and navigating the term sheet negotiation and due diligence phases are all deeply human aspects that challenge straightforward codification into software or machines. Moreover, investment commitments often depend on trust, partnership, shared vision, and intuition between the investor and the entrepreneur, akin to a marriage.

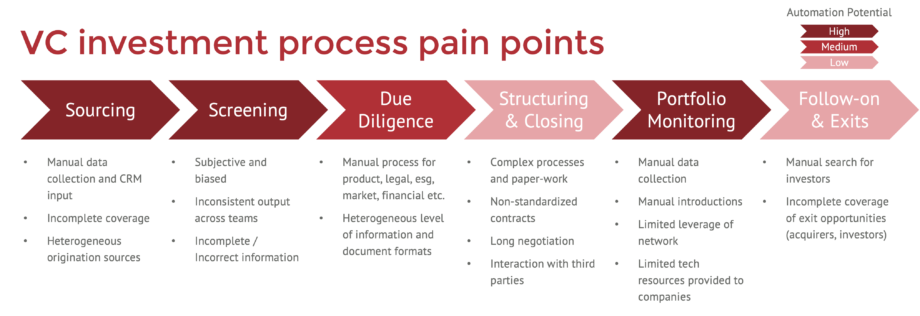

Hence, different phases of the data-driven VC process exhibit varying automation potentials.

In the initial stages of the value chain, such as Sourcing and Screening of investment opportunities, the potential for automation is highest. These stages are highly data-centric, allowing for the use of algorithms to efficiently sift through vast amounts of data to identify promising opportunities.

Similarly, the Portfolio Monitoring phase, which involves collecting and analyzing key performance indicators (KPIs) from companies and maximizing the VC network’s potential through advanced data analytics, is well-suited to automation.

In contrast, the Due Diligence phase presents a medium automation potential. Although numerous tools and use cases, especially those driven by Generative AI, are being developed to enhance due diligence by connecting and interpreting diverse data formats in data rooms, the necessity for nuanced judgment and deeper insights into qualitative data still requires significant human involvement.

Furthermore, the phases of Deal Structuring & Closing and Follow-on & Exit demonstrate low automation potential. These stages are critical for establishing trust and negotiating terms, involving intricate interactions with third parties and detailed contract drafting that rely heavily on nuanced human skills and interpersonal relations. As such, these aspects of the venture capital process underscore the indispensable role of human intuition and judgment, elements that are currently beyond the reach of full automation.

This gradation in automation potential across different stages highlights a blended approach where technology complements human expertise, rather than replacing it, ensuring that venture capital retains its strategic and human-centric character even as it leverages the benefits of technological advancements.

Source: Data-driven VC Landscape 2024 & P101 Data Insight

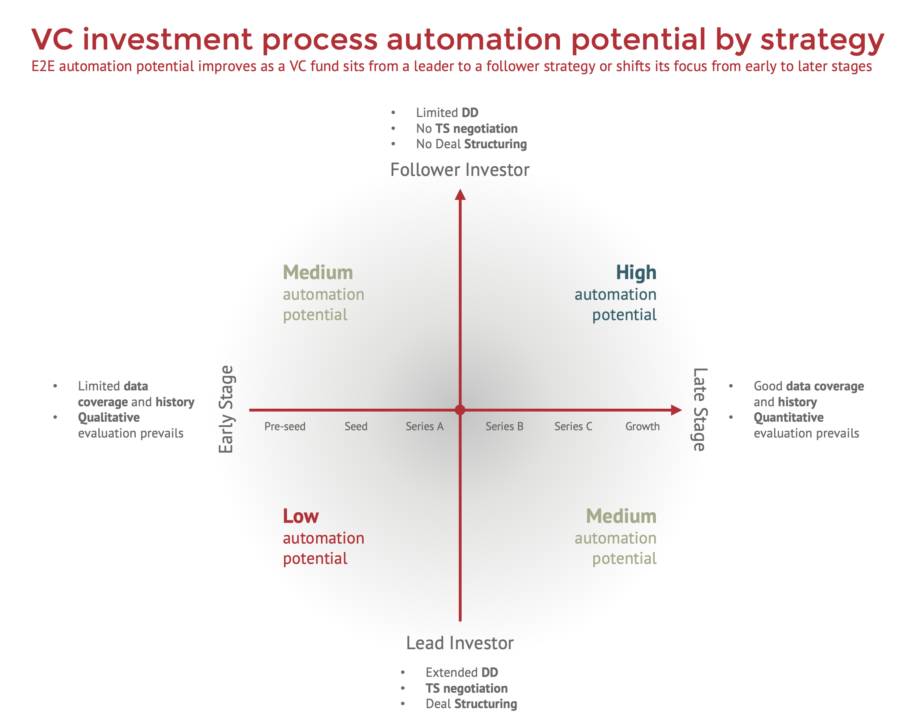

Further dissecting the investment process and considering strategic variables of a VC fund, such as whether a VC acts as leader or follower, and whether it focuses on early-stage or late-stage investments, reveals a different perspective in automation potential:

- Late Stage, Follower Strategy: High end-to-end automation potential. These funds benefit from extensive data availability and historical performance metrics of target companies and markets. Investment decisions in this context are primarily driven by quantitative data. Additionally, as follower investors often engage in limited due diligence and are not deeply involved in negotiating terms or deal structuring, the process lends itself more easily to automation.

- Early Stage, Leader Strategy: Low end-to-end automation potential. Pre-seed and Seed investments are characterized by scant data coverage and limited historical insight, necessitating a heavy reliance on qualitative assessments. Such funds must undertake comprehensive due diligence with minimal data and take the lead in negotiating all contract terms of a deal, processes that are less amenable to automation. However, this strategy allows for the automation of certain operational aspects, increasing productivity and allowing human capital to focus on where it is most impactful: fostering relationships and strategic decision-making.

Source: P101 Data Insight

For VC funds between these extremes, the automation potential improves as they transition from a leader to a follower strategy or shift focus from early to later stages. Incremental moves along these spectrums enhance the feasibility of automating aspects of the investment process.

In conclusion, while certain elements of the VC investment process, particularly data-rich, late-stage evaluations, can be automated, complete automation remains complex and strategy-dependent. The balance between quantitative ease and qualitative depth dictates the pace and extent of automation in venture capital.

Digitizing VC Investor Relations

Digitizing investor relations and fund administration processes allows VC firms to improve internal efficiencies and offer superior services to Limited Partners, which is essential for attracting and retaining investors in a competitive market.

This strategic move fosters trust and transparency, ensuring effective communication and timely responses, enhancing the sophistication and reliability perceived by investors.

Three main areas can be addressed:

- Streamlined Onboarding and Compliance: Transitioning from manual to automated onboarding processes allows for digital onboarding of investors to be completed in minutes rather than days. Streamlined Know Your Customer (KYC) processes use software to instantly verify identities and perform background checks, reducing turnaround times and staff workload.

- Advanced Investor Portals: Advanced investor portals provide LPs on-demand access to extensive fund data, including proprietary insights, market research, and detailed portfolio analyses. Interactive tools such as chatbots and AI assistants offer immediate responses to LP inquiries, enhancing the investor experience by eliminating the need for scheduled meetings or calls with fund managers. This technology fosters deeper relationships between investors and the fund, such as sharing deal opportunities, involvement in direct investments and leveraging LPs networks to support portfolio companies.

- Automated Fund Administration: Automation in fund administration facilitates the precise and timely management of commitments, capital calls, and distributions. These processes are less prone to errors and are fully transparent, enabling both internal teams and investors to track transactions in real-time. This transparency increases trust and investor confidence as it allows them to view transaction statuses and histories whenever needed.

P101’s Data-Driven VC journey

In 2022, P101 established a dedicated business unit called Data Insight to drive our data-driven transformation. This team orchestrates various initiatives to enhance competitiveness, operational efficiency, and investment effectiveness.

Laying the foundation

We began by thoroughly mapping and redesigning all investment, fund administration, and back-office processes. Thereafter, we created reliable, user-friendly, and scalable databases and data models to support our evolving business needs without compromising efficiency or scalability.

Integrating Off-the-Shelf Solutions

Recognizing the immediate benefits of existing technologies, we initially invested in off-the-shelf investment tech tools. This included everything from data providers to CRM systems, portfolio management, valuation, reporting, and administrative tools. These tools were selected for their quick-win potential, providing substantial value in a relatively short timeframe. Each tool was carefully integrated and configured to align with our specific processes, accompanied by a comprehensive change management and team training program to maximize their utility.

Developing custom solutions

With a solid infrastructure in place, we are now creating a roadmap for developing custom solutions tailored to our unique operational needs.

This roadmap includes plans for data lakes that will aggregate diverse data sources such as web crawlers, news, social networks, job boards, and industry reports. We aim to build sophisticated data processing and analytics layers that will identify market opportunities, spot emerging startups, track key personnel movements, and more.

Other custom initiatives include developing proprietary indexes and signals to score and screen companies, utilizing Machine Learning (ML) models and Generative AI (Gen AI) agents for tasks such as drafting term sheets, conducting due diligence checks, valuing companies, analyzing portfolios, drafting automated limited partner reports, identifying optimal exit scenarios, and collecting and analyzing data from portfolio companies. Additionally, we plan to create custom front-ends to ensure all team members access this rich technological and informational estate, enhancing workflows.

Ongoing evaluation and improvement

To ensure continuous improvement and responsiveness to technological advancements, we hold weekly update sessions. The Data Insight team reviews ongoing initiatives, evaluates new proposals, and adjusts priorities based on a rigorous cost-to-benefit analysis. These initiatives span process reviews, database enhancements, adoption of new tools, automation of existing processes, specific data role hiring, and comprehensive training programs.

Through these efforts, P101 adapts to the demands of a data-driven landscape and sets a benchmark for innovation and efficiency in venture capital management. Our proactive approach to integrating off-the-shelf solutions and planning for custom tools exemplifies our commitment to harnessing data to drive better investment decisions and operational excellence.

Risks and challenges on the road ahead

As venture capital firms transition towards a data-driven approach, they face several significant risks and challenges that could impact the effectiveness and efficiency of their transformation:

- Data Privacy and Security: Handling vast datasets increases risks related to data breaches and compliance with strict data protection regulations like GDPR.

- Integration and Interoperability: Integrating new data tools with existing systems can cause technical challenges, requiring sophisticated solutions to ensure seamless workflow compatibility.

- Cultural Resistance: Shifting to data-driven methods may encounter resistance from employees accustomed to traditional practices, necessitating strong change management strategies.

- Skill Gaps and Talent Acquisition: There is a high demand for skilled data professionals. VC firms must compete with tech giants for this limited talent pool, highlighting the need for effective recruitment and retention strategies.

- Overreliance on Quantitative Analysis: Excessive focus on data can lead to the underappreciation of qualitative factors such as leadership qualities and founder passion, which are crucial in venture capital.

- Cost Implications: The expense of implementing and maintaining advanced data analytics and AI tools can be substantial, particularly for smaller firms, potentially affecting the return on investment.

- Technological Obsolescence: Rapid advancements in technology require continuous updates and investments, posing a challenge to keep pace with new developments without falling behind.

- Data-Driven Bias: There is a risk of perpetuating biases if AI models and algorithms are trained on skewed data sets, necessitating careful scrutiny to ensure ethical use of data.

Addressing these challenges requires careful planning, resource allocation, and ongoing management commitment to ensure the successful integration of data-driven strategies within venture capital operations.

Conclusion

For VCs, the data-driven revolution is not just another trend but a foundational shift essential for survival and success in the digital era. By embracing this change, VCs can enhance their operational efficiency, improve their investment accuracy, and stand out in a crowded market. The journey will require substantial investment in technology and talent, along with a firm commitment to reshaping the organizational culture. Those willing to take the lead will likely find themselves at the forefront of tomorrow’s venture capital landscape, setting new standards for success and innovation.